Call warrant differs from ordinary warrant in the following manners:

1. It is issued by third parties (normally, an investment bank); and

2. It is normally cash-settled.

Its tenure is normally shorter than the usual tenure of 5 years for ordinary warrants. Some of the recent call warrants have tenure as short as 8 months (eg. BJToto-CA & Astro-CA). With such short tenure, call warrant's risk has increased significantly as the chances of it maturing "outside the money" have increased. Therefore, it is fair to say that call warrants are not for the risk averse investors. Nevertheless, call warrants cannot be ignored by the more sophisticated investors because of the leverage afforded for a given amount of funds. Leverage is however a double-edged sword; you may make higher return, but you may also make bigger losses.

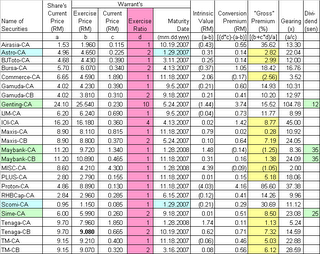

One of the reason why I track call warrants is that there are currently very few warrants issued by blue-chip companies. The only warrants that allow investors to benefit from a blue-chip rally are the call warrants (eg. Genting-CA; Maybank-CA & CB; Tenaga-CA & CB; TM-CA & CB etc). I've set up a spreadsheet for these call warrants & track them carefully (see the table below).

Table: Call Warrant Update as at September 29

You can obtain almost all the above information from the Star newspaper (Starbiz Saturday edition) as well as from the Edge newsletter. The reason why I wrote this post is that both these sources omitted something which is very crucial in the valuation of a warrant i.e. the exercise ratio. I have highlighted this in pink in the above table. The error is likely to be due to the fact that the Warrant Update of these 2 sources comprises ordinary warrants & call warrants; where, until recently, all the warrants' exercise ratio is 1 warrant "convertible" to 1 share. The recent call warrants were issued with differing exercise ratio such as 2-for-1 in the case of Astro-CA, Bursa-CA, Gamuda-CB, Maxis-CB, Sime-CA, Tenaga-CB & TM-CB; 4-for-1 for IOI-CA; and, 10-for-1 for Genting-CA. By ignoring the exercise ratio, Genting-CA would appear to have a premium of 6.9% whereas the correct premium should be 15.5%.

However, it must be stated that the above table only gives a very simplistic view of the "fair value" of call warrants because it does not take into account the tenure of the warrant & the dividend receivable by the underlying shares. A warrant with a longer tenure should command a higher value than one with a shorter tenure, ceteris paribus. And, a warrant of an underlying share that pays higher dividend should have a lower premium that one that pays lower dividend. Nevertheless, these 2 factors can be found in the above table [i.e. warrants with immediate dividend receivable are highlighted in green & warrants with less than 4 months' duration to expiry are highlighted in blue]. To account for these factors, one should use the Black Scholes method of option valuation.

Finally, the most important determinant of how much premium a call warrant may command is the direction of the price movement of the underlying share. If the underlying share is trending upward, the call warrant will be in big demand & this will naturally lead to a higher premium. On the other hand, if the underlying share is trending downward, the call warrant will be sold down & this will lead to a contraction in the premium (or, even trading at a discount).

In the above table, I have highlighted all the call warrants that trade at a reasonable premium [of less than 10%] in yellow. Before making a trade on any of these call warrants, you should satisfy yourself that the call warrants' remaining tenure is acceptable and that the underlying share's near-term potential is exciting.

No comments:

Post a Comment