Courts Mammoth Bhd (“Courts”) is involved in the retailing of electronics & electrical appliances and household furniture & furnishings. It operates in Malaysia & Indonesia.

Past Financial Performance

From the above, we can see that Courts’ net profit has been declining over the past 5 years. In 2006, Courts recorded a miniscule bottomline of only RM1.1 million. This is despite a recovery in turnover since 2004. The recovery in the topline is attributable to higher turnover from its Indonesian’s operation, which Courts had acquired in 2004 from its parent, Courts plc, (which had then run into financial difficulties). The Indonesian operation had contributed 14.0% and 9.7% of Courts’ turnover and operating profit, respectively in 2005. In 2006, the Indonesian operation had contributed 19.7% and 48.2% of Courts’ turnover and operating profit, respectively.

Current Financial Performance

If you compared the last 4 quarterly results with the preceding 4 quarterly results, you can see that turnover has increased by 4.3% from RM 609.1 mil to RM 635.5 mil. Unfortunately, net profit plunged 96.3% from RM30.2 mil to a mere RM 1.1 mil. EPS has similarly plummeted from 10.71 sen to 0.39 sen. The decline in profitability has been attributed to lower profit margin and higher provision for doubtful debts.

Courts- a target for takeover

The receiver [KPMG Corporate Finance (UK)] appointed to manage the affairs of Courts plc has invited bids to buyout its 50.1%-stake in Courts. A sale would automatically entail a mandatory offer by the buyer of all outstanding shares of Courts. The bids were received by the receiver in September 2005 and a decision is pending.

Valuation

Since the financial performance of Courts has shown little signs of a turnaround (except for the Indonesian operation), I think a buyer would value the company on a break-up basis.

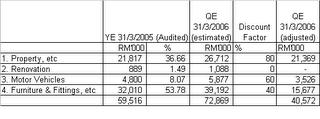

Using the unaudited balance sheet as at 31/3/2006, I have discounted the various assets of Courts and arrived at a "fair value" of RM1.12 per share. I have discounted the assts as follows: 100% for goodwill, 50% for inventories, 25% for receivables, 10% for deferred tax & tax recoverable (see Table 1). Fixed Assets ("F.A.") has been discounted as follows: 100% for renovations, 60% for furniture & fittings, 40% for motor vehicles and 20% for properties. As no F.A. breakdown was given, I had assumed that the breakdown is proportionately similar to that of FYE 31/3/2005 (see Table 2). The "fair value" of RM1.12 is 42% lower than Courts' book value as at 31/3/2006.

Table 1: Computation of "Fair Price" per share.

Table 2: Computation of F.A.'s fair value

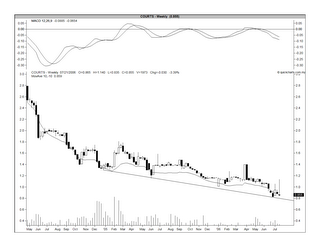

Technical Outlook

The chart below shows that the stock is in a downtrend. A line plotted against the troughes (since October 2004 up to today) indicates that the stock has some support at the RM0.80 level. A 20-day MA (shifted 10% downward) seems to also show that the RM0.80 level to be a good support level.

Chart: Courts' weekly chart as at July 20

Risks

No attempt has been made to calculate the cost of closing Courts' operation. The closure cost could be substantial. Similarly, no attempt was made to estimate the fair value of its profitable & fast-growing Indonesian operation. This business is very promising and could easily fetch a premium above its book value.

Recommendation

Based on the above, I believe Courts to be a good buy at the RM0.80 level. Assuming that the takeover price is set at RM1.12, your return would be about 40%. Timeframe is about 9 to 12 months.

No comments:

Post a Comment