1. Magnum has cancelled 133 million treasury shares (equivalent to 8.42% of its share capital) last month;

2. It has also completed its disposal of a Hong Kong-based subsidiary which resulted in the settlement of a HK121.2 million inter-company loan last month; and

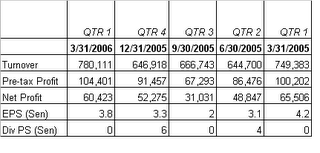

3. Its performance has also improved due to lower payout ratio and increased market share. The latter may be attributable to the introduction of mBox 4-D permutation game (see the Table below).

All these could well put this stock back into investors' radar screen. The cancellation of the treasury shares would be earning accretive while the settlement of the inter-co loan would finally put an end to the issue of corporate governance that had hobbled Magnum since the Asian crisis.

Magnum's share price movement yesterday (July 18) and this morning is very interesting. Yesterday, Magnum gained 4 sen to close at RM1.89 on a volume of 34806 lots (highest volume traded for the past 3 months). This morning, Magnum share price went as high as RM2.07 before closing at RM2.03 (gaining 14 sen). Volume traded up to 3.00 p.m. was about 71000 lots. The share price was weaker due to new development in the Middle East, which saw Isreali tanks entering Lebanon.

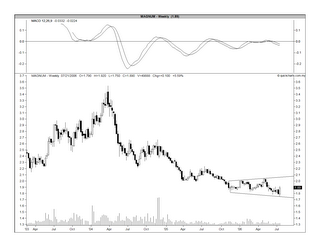

From the chart below, you can see that the share price has been tracing out a bottoming process that looks like a diamond formation. A break above RM2.06/2.07 could signal the end of the downtrend that begun in March 2004. If this stock were to recover over the next few days and surpass the rising overhead resistance, I would recommend that you buy this stock.

Chart: Magnum's weekly chart as at July 18

No comments:

Post a Comment