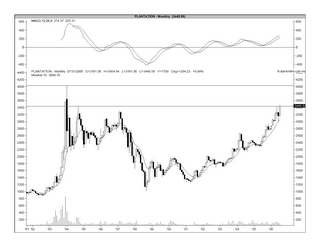

Chart 1: Plantation's monthly chart as at July 24

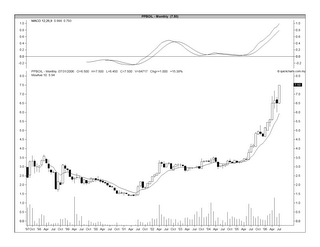

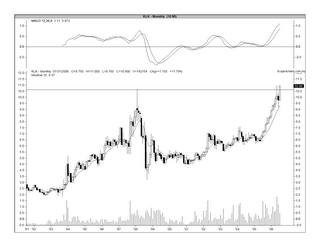

This morning, a few plantation stocks has surpassed their May highs, which in turn are their respective all-time highs. These stocks are PPB Oil, KL Kepong & IOI Corp. KL Kepong's parent i.e. Batu Kawan has also made a new high after surpassing its recent all-time high that was recorded in Feb this year. I have appended below their monthly charts for your viewing (see Chart 2, 3, 4 & 5).

Chart 2: PPB Oil's monthly chart as at July 24

Chart 3: KL Kepong's monthly chart as at July 24

Chart 4: IOI Corp's monthly chart as at July 24

Chart 5: B Kawan's monthly chart as at July 24

It is worth noting that most of the government-linked plantation companies such as G Hope, High & Low and K Gurthrie have yet to made a new high. So are some big plantation counters such as Asiatic & United Plantation. It would be interesting to see whether these counters would be able to break above their all-time high when the Plantation index finally tests the 4000 psychological level & its all-time high of 4044. At this moment, one stock that interests me is Rimbunan Sawit, a Sarawak-based plantation company that was listed last month. Its IPO price was RM1.00 and Kenanga has a fair value of RM1.50 for this stock. Based on the chart below (Chart 6), the stock has a recent high of RM1.37. This morning, it surpassed this high & momentarily touched a high of RM1.40. From a technical point of view, this stock looks very "tradable".

Chart 6: RSawit's daily chart as at July 24

No comments:

Post a Comment