The decline in APM share price is a reflection of the poor performance of the auto sector in the past few months. For instance, we have a piece of news today in the Edge Daily about Nissan/Edaran Tan Chong Motor Sdn Bhd ("Nissan/ECTM") reporting an 18%-drop in vehicles sales in the second quarter of 2006 (2Q06) to 5,496 units from 6,705 units a year ago due to the instability of used-car prices, more stringent car loan requirements by finance companies, and escalating cost of car ownership. Nissan/ECTM is related to APM. Despite the depressed conditions in the auto sector, a solid company such as APM should be able to survive and, even, prosper. The earlier BUY call, which was based on technical consideration, is however cancelled until clearer signs that the stock has bottomed.

Chart 1: APM's monthly chart as at August 8

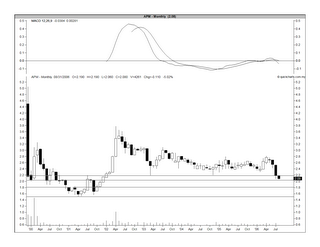

Chart 2: APM's weekly chart as at August 8

No comments:

Post a Comment