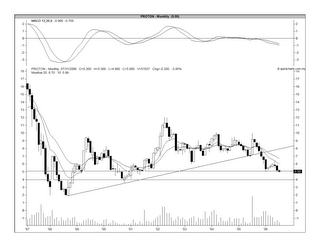

Chart 1: Proton's monthly chart as at July 31

Comments: Proton's long-term uptrend that dates back to 1998 was broken in Nov 2005 at the RM7.40 level. The stock has been testing its strong horizontal support of RM5.00 for the past 2 months. A break of the RM5.00 support could easily see Proton going down to RM4.00 or RM3.50.

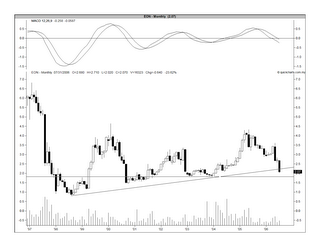

Chart 2: EON's monthly chart as at July 31

Comment: EON's long-term uptrend also dates back to 1998. The uptrend line support is at RM2.30 but it appeared to be have convincingly broken yesterday when EON dropped 18 sen to close at RM2.07. If no recovery happens soon, we shall consider the uptrend line as broken and the next support would be the horizontal support of RM1.80.

I consider the bulk of the bad news for EON as out while the last shoe may not have dropped for Proton yet. Proton is faced with excess capacity & probably a lot of doubtful assets (i.e. trade debts & investments). A VSS is probably on the way. Further assets write-off is also likely. As such, the share may see further selloff at that point. Only after that, would we see some stability in the share price of Proton. A recovery in the share price of both EON & Proton is however a diferent matter & for that, you would require clearer signs that EON & Proton's futures are built on firmer foundation than what they have today.

No comments:

Post a Comment