Malayawata Steel Bhd (“Malayawata”) is essentially a steel miller producing steel bars & billets. It also has a small oil palm estate and some investment in properties.

Malayawata is a 67.67%-subsidiary of Ann Joo Resources Bhd (“Ann Joo”), a company that is also listed on Bursa Malaysia. Ann Joo has acquired a 30.03% stake in Malayawata in March 2000 from Pernas International Holdings Bhd at a cost of RM201.6 mil (or RM3.33 per share). The stake was subsequently raised to 32.99% as at 31/12/2005 & the average cost was lowered to RM3.06 per share. In October 2005, Ann Joo has made a voluntary offer to acquire all remaining shares in Malayawata at RM1.50 per share. At the close of the offer (in January 2006), Ann Joo has managed to increase it stake in Malayawata to 67.67%. The average cost of Malayawata share in Ann Joo’s book now stands RM2.26.

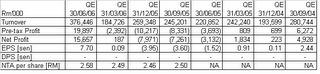

Past & Future Financial Performance

From the above, we can see that Malayawata's turnover has grown at an average compounded rate of 20% from RM 453 mil in FYE 2001 to RM 933 billion in FYE 2005. Except for a loss of RM22.2 mil for FYE2001, Malayawata has been reporting net profit that averages between RM20 mil and 30 mil per annum. Based on S&P's research report dated August 1, Malayawata is expected to report a net profit of RM 33.9 mil for FYE 2007 on the back of a turnover of RM 1.493 billion. 2007 EPS is forecast to be about 16.8 sen.

Current Financial Performance

Malayawata reported a substantially better set of result for the QE 30/6/2006. Turnover increased by 104% q-o-q or 70% y-o-y to RM376 mil. Net profit jumped to RM15.7 mil as compared to a mere RM187k in the preceding quarter or a loss of RM3.1 mil in the same quarter last year. Consequently, EPS has also improved to 7.7 sen for the QE 30/6/2006.

From the result announcement, one can see that the jump in the net profit flows directly from the jump in the turnover & it is not due to any extraordinary or exceptional item. The company has also not cautioned the reader that the high turnover may not be sustainable. In fact, the Directors are “optimistic that the Group’s performance for the coming financial period will be better than that of the preceding year”. The only negative things that they have highlighted are the raw material price instability & the impact of the recent electricity tariff hike.

Since the jump in the net profit is so huge; most analysts (including the analyst who prepared the S&P report mentioned earlier) would be hard pressed to raise the net profit & EPS numbers, but by how much? Can Malayawata sustain such a good performance? The S&P analyst has forecast an EPS of 16.8 sen for 2007. Since the EPS for 1Q2007 is already 7.7 sen, the analyst is assuming that the next 3 quarters’ combined EPS to be 9.1 sen or an average of slightly more than 3 sen per quarter. Is that too conservative?

On the other hand, it may be too optimistic to assume EPS for 2007 to be 30.8 sen (4 x 7.7 sen). I am going to assume that the EPS to be the average of this optimistic EPS of 30.8 sen & S&P’s forecast of 16.8 sen. This works out to be 23.8 sen.

Valuation

Based on the closing price as at yesterday (August 1) of RM 1.28 & EPS of 23.8 sen, the stock is trading at a PE of 5.4 times. This is relatively cheap. It is equally cheap when you compare the share price to its book value; giving a price to book of only 0.5 times.

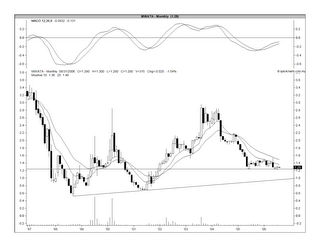

Technical Outlook

From Chart 1 below, you can see that Malayawata is still in a bottoming process as well as caught in a range between RM1.23 and RM1.48. A break in either direction will point the way forward.

Chart 1: Malayawata's weekly chart as at August 1

The very long-term chart (Chart 2) saw the stock to be in a gradual uptrend. In addition to the strong horizontal support of RM1.23, the long-term uptrend line support is at RM1.00.

Chart 2: Malayawata's monthly chart as at August 1

Recommendation

Based on relatively cheap valuation, I would recommend a BUY for Malayawata at the current price of around RM1.23. You may do swing trading for this stock i.e. buy near RM1.23 & sell near RM1.48. The stock will only be technically bullish after it has broken above the RM1.48 level.

No comments:

Post a Comment