Megan Media Corp Bhd ("Megan”) is involved in the production of CDs, DVDs & Video Tapes. The group has undertaken a fair extensive expansion program in the past 2 years, which saw it taking over another company within the same business from its parent company.

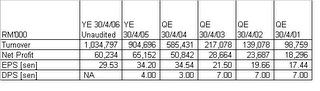

Past & Future Financial Performance

From the above, we can see that Megan's turnover has grown from RM 98.8 mil in FYE 2001 to RM 1.034 billion in FYE 2006. During that period, its net profit had tripled from RM 18.3 mil to RM 60.2 mil. Based on S&P's research report dated July 4, Megan is expected to report a net profit of RM 83.0 mil for FYE 2007 on the back of turnover of RM 1.062 billion. 2007 EPS is forecast to be about 40.4 sen.

Current Financial Performance

If you compared the last 4 quarterly results with the preceding 4 quarterly results, you can see that net profit has declined by 9.0% from RM 66.2 mil to RM 60.2 mil. EPS has dropped by 36.1% from 46.2 sen to 29.5 sen. The poorer net profit came about despite a 14.4%-increase in turnover from RM 904.7 mil to RM 1.035 billion.

Valuation

Based on the closing price today (Aug 21) of RM 0.61 & trailing EPS of 29.5 sen, the stock is trading at a PE of 2.1 times. This is very cheap. It is equally cheap when you compare the share price to its book value; giving a price to book of only 0.25 times.

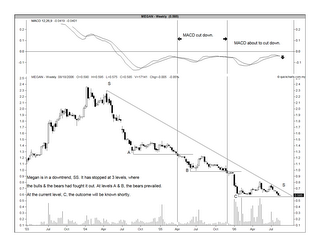

Technical Outlook

Megan made a high of RM2.36 in w/e Jan 9, 2004. Since then, it has been in a downtrend. There are 3 levels where the stock has some good supports i.e. RM1.25, RM1.00 & RM0.56/0.57. It broke through the first 2 supports & it has just tested the third support, which appears to be holding up (see Chart 1 below).

Chart 1: Megan's weekly chart as at July 26

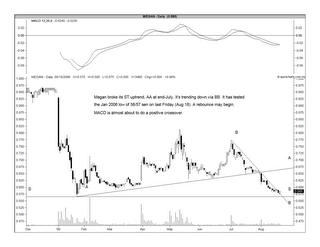

From the daily chart (Chart 2 below), we can see that the stock has tested the RM0.56/0.57 support last Friday (Aug 18). As expected, Megan put in a rebound today & has managed to close at RM0.61. This means that it has broken abouve its immediate downtrend as well as the 10-day MA; both at the RM0.60 level. There is a good chance that the stock may recover from this level.

Chart 2: Megan's daily chart as at July 26

Future Prospect

In the aforementioned July report, S&P has called a SELL on Megan because the optical disc industry is experiencing severe overcapacity (due to over-expansion in China & Taiwan). The situation is so bad that Megan has opted to outsource some of its production rather than expanding its in-house capacity. Out-sourced products only enjoyed a margin of 2-3% as compared to 25-30% margin for in-house products.

In addition, SJ Securities in its July 4 report has upgraded its rating of Megan to a HOLD from a SELL (which is based on its report dated Apr 6). SJ Securities is still uncomfortable with the high gearing of Megan.

Weakness noted

The weaknesses are as noted in the 2 research reports i.e. over-capacity in the industry & high gearing. After looking through its balance sheet as at April 30. 2006, I've ascertained that the group's bank borrowings totaled RM838.7 mil as compared to its shareholders' funds of RM470.7 mil. This gives a gearing ratio of 1.78 times.

Recommendation

Based on cheap valuation, I would believe that Megan to be a good long-term investment. The negative news is probably all priced in at this level. While the technical picture has yet to turn positive, I feel that the downside risk is very low.

No comments:

Post a Comment