Plenitude Bhd (“Plenitude”) is involved in property development & investment. Its major projects include Taman Desa Tebrau in Johor Bahru, Taman Putra Prima in Puchong, Bandar Perdana in Sg. Petani and Changkat Kiara in Sri Hartamas. Its property development is likely to last for the next 10-15 years as it has a large landbank of about 2000 acres, located in Johor Bahru & the Klang Valley.

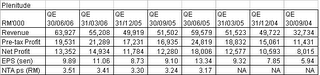

Current Financial Performance

It reported a poorer performance for 4Q2006. Its net profit dropped by 10.6% q-o-q or 25.9% y-o-y to RM 13.3mil. This was despite a higher turnover, which has increased by 15.8% q-o-q or 7.3% y-o-y to RM 63.9 mil. Nevertheless, we can take comfort in knowing that Plenitude's financial performance for 2006 is better than last year's performance. Its turnover for FYE 2006 is 14.0% higher than that of FYE 2005. Consequently, its net profit is 6.4% higher at RM 52.4 mil.

Valuation

S&P has forecast a 2007 EPS of 48.6 sen for Plenitude in its research report dated August 22, 2006. This is an increase of almost 10 sen from the 2006 EPS of 38.8 sen. If we average the unaudited 2006 EPS & S&P's 2007F EPS, it works out to be about 43.7 sen. Based on this figure & the share price of RM1.48 (today's closing price), Plenitude is now trading at a PE of 3.4 times.

Because of the cheap valuation, S&P has a STRONG BUY on Plenitude, with a 12-mth target of RM1.78.

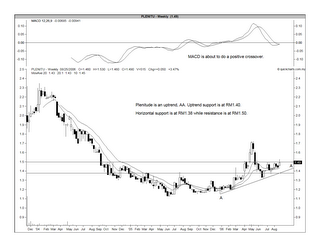

Technical Picture

Plenitude is in an uptrend, with the support at RM1.40. Immediate horizontal support & resistance are at RM1.38 & RM1.50, repectively.

Chart: Plenitude's weekly chart as at August 22

Recommendation

I believe Plenitude is a very good property stock that is trading now at very undemanding valuation.

No comments:

Post a Comment