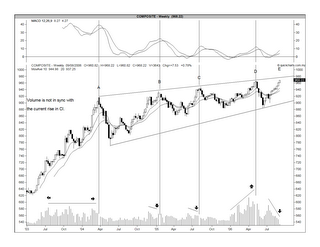

The CI has been climbing a wall of worry for the past 6 weeks. As noted in an earlier post, the CI has been going up on thinning volume (see Chart 1 below). One day after a pretty decent budget that surprises many with a 2%-reduction in corporate tax rate [from 28% to 26%] over 2-year period, the CI responded in a nonchalant manner by doing what it does best i.e. to go up in an unhurried fashion and very little fuss. But, it will have to break out of its current stride soon as it approaches the important level & a pretty strong resistance of 970, which was the high recorded by the CI in May this year. While I am tempted to say that it is quite hard for the CI to break through this level, a quick look at the current CI has convincing me that I am wrong. At 9.10 a.m. this morning, the CI has indeed broken above the 970 level to reach a high of 970.49 before pulling back to 969.84. The CI will go back & forth for the rest of the day & we will have to wait for the final outcome.

Chart 1: CI's daily chart as at Sep 4

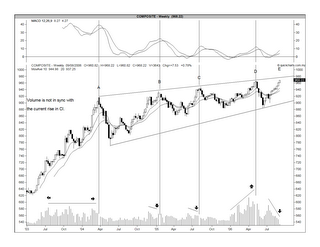

Chart 1: CI's daily chart as at Sep 4If the CI can surpass the 970 level, it may then test the 980 level. The latter is the resistance posed by the bearish wedge that the CI has been trapped in for the past 2 to 3 years (see Chart 2 below). Also, I have appended Chart 3 where you will see that the divergence between the volume & the index extends to the weekly chart as well.

Chart 2: CI's weekly chart as at Sep 4

Chart 2: CI's weekly chart as at Sep 4 Chart 3: CI's weekly chart as at Sep 4

Chart 3: CI's weekly chart as at Sep 4So, for the next few days, we will see whether the CI can surpass the 970 level or not; and if it can do so, whether it will surpass the 980 level or not. I believe that somewhere between 970 & 980, the CI may come to “

a bridge too far” & hopefully its retreat will not be too bloody.

No comments:

Post a Comment