Green Packet is involved in the research, development, manufacturing, marketing & distribution of wireless networking & telecommunication products, networking solution & other technology products & services.

Recent Development

Recently, one of Green Packet's associate company, GMO Limited ("GMOL") was listed on the Alternative Investment Market of the London Stock Exchange on Wednesday, 6 September 2006.

Past 4-year Financial Performance

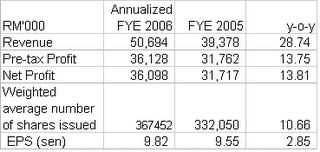

Since the listing of this company on the Mesdaq Board in May 2005, Its financial performance has been very impressive. From Table 1 below, you can see that its turnover has grown from RM5.1 mil in FYE2003 to RM39.4 mil in FYE2005. Net profit has increased from RM2.9 mil to RM31.7 mil during the same periods.

Table 1: Past 4-year Financial Performance

Recent Financial Performance

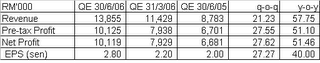

The latest 2Q2006 results shows a net profit increase of 27.6% q-o-q to RM10.1 mil which was achieved on the back of a 21.2% q-o-q increase in turnover to RM13.9 mil. When compared to the corresponding quarter in FYE2005, the net profit has increased by 51.5% while turnover has increased by 57.8%. See Table 2 below.

Table 2: Latest quarterly results compared

However, if you compared the annualized FYE2006 with the actual FYE2005 (see Table 3 below), you would notice that the scorching growth rate has moderated from 117% in FYE 2005 to a more comfortable 29% while pre-tax profit margin has eroded somewhat from 81% in FYE2005 to 71% in FYE2006. The slide in pre-tax profit margin plus the slower growth in turnover are clear indications that competition is picking up. Over the next few quarters, we will see whether Green Packet can weather the tougher operating environment and stay ahead of the competition.

Table 3: Annualized FYE2006 & Actual FYE2005 compared

Technical Outlook

The technical outlook of Green Packet has turned a bit cloudy of late. This may in part be due to the on-going correction in the Mesdaq Board. It is also likely that some investors in Green Packet may be taking profit on the stock in view of its slower growth in turnover & a slight contraction in pre-tax profit margin.

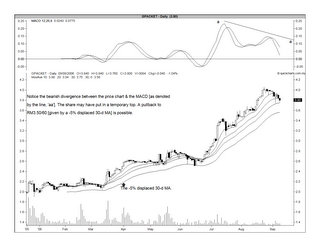

From the chart below, we notice that the MACD has a bearish divergence when compared to the upward movement of the share price. The share price has pulled back to the 30-day MA of RM3.74 at 10.00 a.m. this morning. Further weakness will put Green Packet below its 30-day MA, which happened in June this year. However, the -5% displaced 30-day MA has been supportive in the event of a correction & I expect this may do the same again. That level is at RM3.50/60 now. However, a break below RM3.50 could mean a more severe correction for this stock.

Chart: G Packet's daily chart as at Sep 8

Conclusion

Green Packet may have put in a temporary top recently. Look out for the test of the 30-day MA [at RM3.74] & the -5% displaced 30-day MA [at RM3.50/60]. Be forewarned that a break of the latter could have serious consequences for the stock.

No comments:

Post a Comment