Malaysian Plantations Bhd (“MPlant”) is mainly involved in the provision of financial services such as commercial banking, financing, merchant banking, stock broking, unit trust management & investment advisory services. The main subsidiary is Alliance Bank Malaysia Bhd.

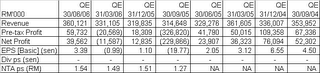

Recent Financial Performance

MPlant has gone through a period of consolidation in the first half of FYE31/3/2006 (after Temasek has taken over the driving seat in the company). A spring clean of its books has resulted in loan loss provision and impairment loss of RM478 million being booked into its accounts during that period. The impact was very noticeable for 2Q2006, which ended 30/9/2005, where the specific provision and impairment loss of RM415 million were recorded & this has resulted in a net loss of RM229.9 mil.

In 4Q2006, which ended 31/3/06, MPlant has again reported a net loss of RM11.6 mil, which was “mainly due to lower net interest income and other operating income, coupled with higher operating expenses and loan allowances.”

For 1Q2007, MPlant has reported a 65.5%-jump in its net profit y-o-y to RM39.6 mil which was achieved on the back of a 9.4%-increase in turnover to RM360 mil. The turnover recorded in this latest quarter is one of the highest in the past 8 quarters (except for 4Q2005). The company attributed the improved performance to “higher net income, including net income from Islamic Banking business which improved by RM11.2 million or 73.2% and lower specific allowances being made coupled with stronger recoveries for the period under review.”

Valuation

Based on the EPS for 1Q2007 of 3.39 sen, MPlant’s annualized EPS for FY2007 is about 13.56 sen. Based on its closing price of RM2.16 as at September 15, MPlant is now trading at a PE of 16 times. This is not a cheap price to pay for a small bank in Malaysia.

If MPlant is subject to a speculative takeover play (which is unlikely given that Temasek has plans for MPlant), then the likely valuation is the 'Price to Book' method. Using this method & assigning a multiple of 1.95 times (same as what Commerce paid for Southern Bank), then MPlant may be valued at RM3.00 (i.e. RM1.54 multiplied by 1.95). As such, some may still find MPlant to be inexpensive at the current level.

Technical Picture

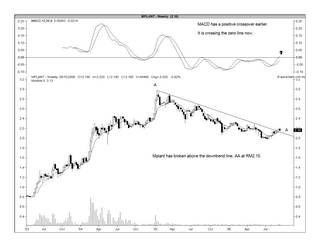

From Chart 1 below, we can see that MPlant has clearly broken above the downtrend line at the RM2.15 level. With this breakout, it is now fairly safe to buy into MPlant.

Chart 1: MPlant's weekly chart as at Sept 15

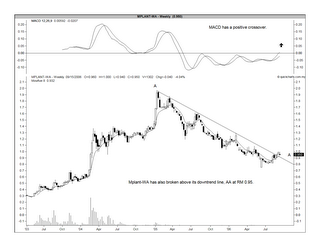

In addition to the share, we can also look at MPlant-WA (closed at RM0.95 as at September 15). This warrant has an exercise price of RM1.21 and expiring in June 2007. Based on the closing price on September 15, the warrant is trading at its intrinsic value without any premium. This could be attributable to its short remaining tenor to expiry. The technical outlook for the warrant is similar to that's of the mother share, which is a positive breakout.

Chart 2: MPlant-WA's weekly chart as at Sept 15

Recommendation

Based on the above, I believe MPlant is a safe LT investment. For those who like some leverage, you can look at the warrant. But, be forewarned that the warrant shall expire in 10 months' time.

No comments:

Post a Comment