When you look at the performance of the various classes of assets in the US, you will find that REIT has been a consistence performer in recent years (see Table 1 below).

Asset class proxies: Vanguard REIT ETF, iShares Russell 2000, iShares MSCI Emerging Markets, MSCI EAFE, S&P 500 SPDR, Vanguard High-Yield Corporate, PIMCO EM Bond, Morningstar Short Gov't Category, PIMCO Foreign Bond, iShares Lehman Aggregate Bond, Vanguard Inflation Protected Securities Fund, Credit Suisse Commodity Return Strategy Fund.

The Malaysian scenario

In Malaysia, investors’ acceptance of REIT has been slow due mainly to its unexciting return. To spur the development of REIT as a vibrant class of assets, many measures had been introduced over the years. The recent budget has proposed the followings:

(1) Dividends received by local and foreign individual investors and local unit trusts from listed REITs be taxed at 15 per cent, and for foreign institutional investors at 20 per cent. These incentives will be given for five years; and

(2) The tax treatment for REITs is further improved whereby the undistributed income from REITs is exempted, provided REITs distribute at least 90 per cent of their income.

Current REITs & how they stack up

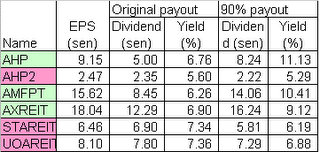

I have tabulated below all the REITs listed on Bursa, except for Tower REIT & Alaqar as their records are too short. The financial results of AHP, AHP2 & AMFPT are based on their latest 4 quarterly results while those of AXREIT, STAREIT & UOAREIT are annualized numbers based on the latest 3 quarterly results in the case of AXREIT & latest 2 quarterly results in the case of STAREIT & UOAREIT.

Table 1: Financial results of all REITs listed on Bursa (excl. TWRREIT & Alaqar)

From this, we can come to the following observations:

1. AHP & AHP2 are trading at substantial discount to their book value. Their Price-to-Book multiples are 0.56 times for AHP & 0.46 times for AHP2.

2. The pricing for AHP2 may reflect its poor Return on Shareholders’ Funds of only 2.71%. This return is computed by using EPS as the numerator & NTA as the denominator. The poor return for the case of AHP2 can also be seen by its high PE of 17.0 times.

3. In term of Return on Shareholders’ Funds, AMFPT & AXREIT are way above the field with 10.48% & 12.98%, respectively. Despite the high return, these 2 REITs are not among those giving the highest Dividend Yield because their Dividend Payout ratios are fairly moderate at 54.10% for AMFPT & 68.13% for AXREIT.

4. STAREIT & UOAREIT, the newest REITs on this table, have very high Dividend Payout ratio of 106.81% & 96.30%, respectively. Because of this, their Dividend Yields at above 7.3% are higher than those of AMFPT (of 6.26%) & AXREIT (of 6.90%).

So, which REITs have good value

I think we can use 2 approaches to pick the better REITs. The first approach is to select those that have the high Return on Shareholders’ Funds i.e. AMFPT & AXREIT. Between them, AXREIT has a slightly higher Dividend Yield of 6.90% as compared to AMFPT’s 6.26%. This is due to AXREIT’s higher Return on Shareholders’ Funds & higher payout vis-à-vis AMFPT. Because of these, the market is prepared to accept a higher Price to Book of 1.28 times to own AXREIT when compared to AMFPT’s Price to Book of 0.91 times.

The second approach is to select those that have low Price to Book i.e. AHP & AHP2. We have already noted the poor Return on Shareholders’ Funds on the case of AHP2. This is not true for AHP, which has a moderate Return on Shareholders’ Funds of 6.98%. This Return on Shareholders’ Funds is comparable to those of STAREIT & UOAREIT but yet, AHP is trading at a Price to Book that is about half of those of STAREIT & UOAREIT. Because of the low Price to Book that the market is prepared to pay to own AHP, AHP’s Dividend Yield of 6.76% is almost at par with that of AMFPT (of 6.9%).

I believe that by using the above approaches, you will find AMFPT, AXREIT & also, AHP are the better REITs. Lastly, I have done a table, where I’ve equalized the dividend payout ratio of all the REITs to 90% of earning and you can see that the Dividend Yield of 3 REITs marked out in green (AHP, AMFPT & AXREIT) would move up sharply while that of AHP2, STAREIT & UOAREIT (marked out in pink) would decline. This shows that AHP, AMFPT & AXREIT have the potential to surprise on the upside.

Table 2: REITs' dividend yield (currently & assuming 90% payout)

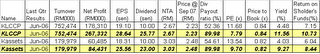

What if KLCCP & Kassets are REITs?

Some analysts have suggested that KLCCP or Kassets may be used as a benchmark for determining the performance of the REITs listed on Bursa Malaysia. Here, I would like to look at how their bottomlines would look like if they were REITs instead of being normal property investment & development companies (see the Table below).

The table below was computed based on 2 important assumptions i.e. the dividend payout ratio is at 90% & no tax is payable. The original results & the amended results are tabulated together, with the amended results marked out in yellow.

Table 3: KLCCP & KAssets' financial result & projection

From the above, we can observe the following:

1. KLCCP's Return on Shareholders’ Funds (of 10.73%) is about the same as those of AMFPT (of 10.48%) & AXREIT (of 12.98%).

2. Based on a dividend payout ratio is at 90% of earning, KLCCP's dividend yield would be about 11.56%. This would match the dividend yield of AHP (of 11.13%) & AMFPT (of 10.41%), if their dividend payout ratio is at 90%. AXREIT's dividend yield (based on dividend payout ratio is at 90%) would come out slightly short at 9.12%.

Conclusion

AMFPT & AXREIT stand out as the better-managed REITs and more attractively priced. Though AHP's Return on Shareholders' Funds is lower than AMFPT & AXREIT, it is priced accordingly and as such, it is also an attractive REIT.

No comments:

Post a Comment