Kotra is involved in the development, manufacturing and marketing of a range of pharmaceutical products. Its products can be divided into 2 categories, which are sterile and non-sterile products. Sterile products consist of injectables in the form of liquid & powder, which provide a direct and immediate action on the end users. Non-sterile products comprise of capsules, tablets, syrup, suspension and cream, which are specifically formulated for oral and external use.

Recent Development

On Oct 9, Kotra has proposed the following:

1. A bonus issue of 6-for-5; and

2. A transfer of its listing from Mesdaq to the Main Board.

Recent Financial Results

From the above, we can see that Kotra's net profit has increased by 58.5% q-o-q or 70.5% y-o-y to RM3.4 mil. This is on the back of a turnover of RM20.3 mil, which represents an increase of 14.1% over the preceding quarter's turnover or 30.5% over the turnover of the corresponding quarter last year. EPS for the last 4 quarters totaled 17.8 sen.

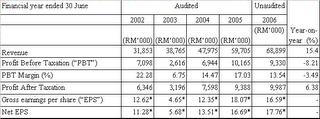

Past 5 years performance

Kotra's turnover has been rising steadily from RM31.9 mil in 2002 to RM68.9 mil in 2006. During the same periods, its net profit has also increased from RM6.3 mil to RM10.0 mil. EPS has increased from 11.3 sen to 17.8 sen.

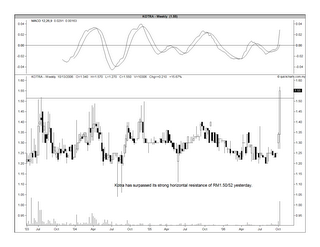

Technical Outlook

Kotra has broken above its strong horizontal resistance of RM1.50 yesterday. See the weekly chart below.

Chart 1: Kotra's weekly chart as at Oct 11

You can see that this horizontal resistance stretched back for earlier 2002. As such, this break can lead to a powerful move. See the monthly chart below.

Chart 2: Kotra's monthly chart as at Oct 11

Conclusion

Kotra could be a good trading buy. Unfortunately, this post is a tad late because the share price of Kotra is now at RM1.62.

No comments:

Post a Comment