There is a good chance that this correction may end soon as the share may find support at the short-term uptrend line, which started in June this year. That support is near RM0.515. If this support fails, the share may go to the psychological support of RM0.50 or even the RM0.46 level, where we can see supports from both the horizontal line & the potential medium-term uptrend line (which starts from Jan this year). See the daily chart below.

Chart: MEMS' daily chart as at Sep 29

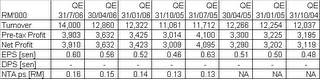

There were a number of reports stating that MEMS is likely to secure a substantial contract soon. This may have boosted its share price but, without any announcement being not made, the rally could not sustain. Recently announced results did not show any significant improvement in the company's topline nor bottomline that may justify the sudden surge in the share price. At an annualized EPS of 2.14 sen, MEMS (closed at RM0.515 today) is now trading at a PE of 24 times.

Nonetheless, the RM0.515 level may be a good entry level for a trade on this stock. The share may drop momentarily to RM0.50 and if it can recover back to the ST uptrend line, an entry established at around this level is acceptable.

No comments:

Post a Comment