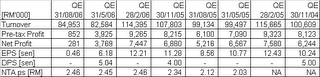

Suiwah has reported its results for QE31/8/06 yesterday. Its net profit plummeted by 94.6% y-o-y or 92.5% q-o-q to RM281k. Turnover of RM85.0 mil represents a 14.3%-decline when compared to the previous corresponding quarter’s turnover but 2.9% higher than the turnover of the preceding quarter. Suiwah attributed its poor result to intense competition in the Flexible Printed Circuit ("FPC") boards sector, one of the group’s two main core business. The other core business is retailing. See the table below.

Technical Outlook

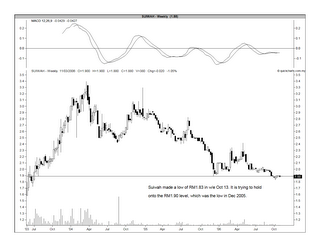

Suiwah is barely holding onto its long-term uptrend line at RM1.90 (see the monthly chart, Chart 1 below). From the weekly chart (Chart 2), we can see that Suiwah has momentarily made a low of RM1.83 in w/e Oct 13, which is lower than the low of RM1.88 made in December last year.

Chart 1: Suiwah's monthly chart as at Oct 30

Chart 2: Suiwah's weekly chart as at Oct 30

Conclusion

With the sharp deterioration in the financial performance, Suiwah may not be able to hold onto its current support of RM1.90 (or, marginally below that). A convincing break would see a sharp selloff in Suiwah. It maybe prudent to dispose of Suiwah at this stage & wait for the dust to settle.

No comments:

Post a Comment