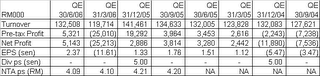

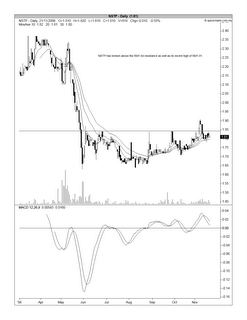

The share price also reflects NSTP's fortune. From a high of RM5.10 in Feb 2004, the share price has dropped to a low of RM1.63 in Jun 2006. Since then, the share price has been bottoming out with its rise capped at RM1.84. A recent attempt to break above this level went as high as RM1.91 on Nov 8 before succumbing to selling pressure. This morning, NSTP has again surpassed the RM1.84 level & also breaking above its medium-term downtrend line at RM2.00 level. At the close of the morning session, NSTP was trading at RM2.03. See the daily & weekly charts below.

Chart 1: NSTP's weekly chart as at Nov 21

Chart 2: NSTP's daily chart as at Nov 21

If NSTP can hold above the RM2.00 level, there is a good chance that the share can go higher. An entry at RM2.00 would be relatively safe.

good write up on nstp alex. Overall, nice site and good balance of fundamental and TA view. Also, nice info on the CA. wil be following your site.

ReplyDeleteIf you got time, for some other views, some chatting, you may want to pop by http://investssmart.blogspot.com/ or http://www.thechargingbull.net/index.php/stock-trader-talk/

or

http://tradebursamalaysia.blogspot.com/

Thank you. I'll check out those links.

ReplyDelete