In the past 3 years, investors have been dazzled by BJToto as much as they have been puzzled by Magnum. In two important areas, BJToto has outperformed its rival, Magnum and they are:

1. Past Financial performance

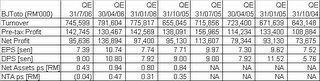

BJToto's net profit has grown from RM284 mil in FYE30/4/2001 to RM465 mil in FYE30/4/2006, on the back of a turnover that has grown from RM2.333 billion to RM2.938 billion. Magnum has grown at a slower rate from RM261 mil in FYE31/12/2000 to RM336 mil in FYE31/12/2005, on the back of a stagnant turnover of RM2.7 billion. As a result thereof, BJToto's EPS has increased from 21.0 sen to 34.4 sen while Magnum's EPS has increased from 8.7 sen to 13.6 sen. See the 2 tables below.

Table 1: BJToto's past 6 years' financial performance

Table 2: Magnum's past 6 years' financial performance

2. Dividend payout plus capital repayment

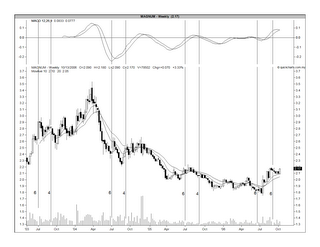

From June 2003 until today, BJToto's dividend payout totaled RM1.57 per share as compared to RM0.42 per share for Magnum. That means BJToto's dividend payout is 274% higher than Magnum's dividend payout. In addition, BJToto has also carried out 2 capital repayments of RM0.50 each in Sep 2005 & Jun 2006. See Chart 1 & 2 below.

On the other hand, Magnum has spent RM285 mil to buy back 133,051,800 units of its own share from 24/7/2001 to 2/5/2006. On 19/6/2006, the entire Treasury shares outstanding of 133,051,800, which represented 8.43% of Magnum’s issued shares, were cancelled. This has the impact of boosting Magnum’s EPS by 9.2%. Thereafter, Magnum has continued with its share buyback & as at 16/10/2006, the Treasury shares in hand totaled 17,913,400 units.

Chart 1: BJToto's weekly chart as at Sep 22, 2006 [with gross dividend (in sen) stated near the bottom of the chart]

Chart 2: Magnum's weekly chart as at Oct 13, 2006 [with gross dividend (in sen) stated near the bottom of the chart]

Things a-changing

In 2 areas, things are beginning to change. They are:

1. Recent Financial Performance

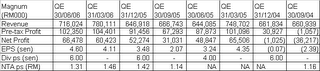

If we compared the last 8 quarters’ results of BJToto & Magnum, we can see that Magnum’s financial performance has improved substantially. Of course, one can say that the sharp improvement is due to the fact that Magnum is starting from a lower base as compared to BJToto, but a significantly higher improvement is still a better story. Here, we note that Magnum’s latest 4 quarterly’s net profit (from 1/7/05 to 30/6/06) totaled RM 210 mil, representing an increase of 172% over the net profit of the preceding 4 quarters. This is despite a turnover that has increased by only 3.5% to RM2.8 billion during the same periods.

BJToto’s net profit for the latest 4 quarterly (from 1/8/05 to 31/7/06) has increased by 18% to RM425 mil over the net profit of the preceding 4 quarters. Turnover has increased by 7.8% to RM3.0 billion during the same periods. For more detail on BJToto's recent results (which is not very straight-forward), go here. See Table 3 & 4 below for Magnum & BJToto's last 8 quarterly results.

Table 3: BJToto's latest 8 quaterly results

Table 4: Magnum's latest 8 quaterly results

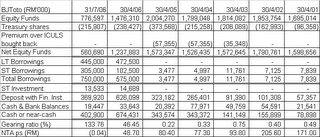

2. Current Financial Position

After a long period of high dividend payout & 2 capital repayments totaling RM1.00 per share, BJToto’s financial position is not as strong as it used to be. Its NTA per share has dropped from a high of RM2.05 as at 30/4/02 to negative 4 sen as at 31/7/06. In addition, it has borrowing totaling RM750 mil as at 31/7/06 as compared to negligible borrowing as recently as 30/4/05. As a result, its gearing position has increased to 1.34 times its shareholders’ funds. If the cash reserves of RM402.9 mil is deducted from its total borrowings of RM750 mil, BJToto’s gearing would improve to 0.62 times as at 31/7/06.

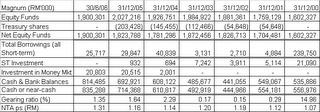

Meanwhile, Magnum has been spending its cash reserve to buy back its shares. The amount spent was smaller & it has not reduced its cash reserve as much as the high dividend payout & capital repayment has impact BJToto’s cash reserve. As at 30/6/06, Magnum’s cash reserve stood at RM835 mil while borrowing was less than RM26 mil. Its NTA per share stood at EM1.31, of which 58 sen is in the form of cash or near-cash. See Table 5 & 6 below.

Table 5: BJToto's Financial Position for the past 6 years

Table 6: Magnum's Financial Position for the past 6 years

What to expect from BJToto & Magnum in the near future?

For BJToto, I expect the dividend payout to normalize. Based on its last 4 quarters’ combined EPS of 34 sen & its current financial position, I do not believe BJToto can continue to pay an annual dividend of 40-50 sen much longer. I wonder how the market would react if and when BJToto shaves its dividend payout.

For Magnum, I believe that its improved financial performance coupled with its stronger financial position may enable the company do one or more of the followings:

a. To continue with its share buyback & possibly, cancellation of such shares;

b. To increase its dividend payout (as done last year, albeit on a small quantum);

c. To privatize its main subsidiary, Magnum4D & improve its result further.

Conclusion

Based on the above, I believe that Magnum is likely to outperform BJToto going forward.

No comments:

Post a Comment