BJToto needs no introduction. It is essentially a gaming company with the main subsidiary being Sports Toto, which runs number forecasting games such as 4 Digit, 4 Digit I-Perm, Super 6/42 & Super 6/49.

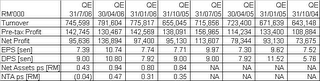

Recent Financial Results

BJToto's latest financial results for QE31/7/06 appears not too good on first glance but, on closer examination, it proves otherwise. Its turnover of RM746 mil for QE31/7/06 represents an increase of 4.2% over the turnover for QE31/7/05. Pre-tax profit of RM143 mil is however 16.9% lower than the pre-tax profit for QE31/7/05. The drop is actually due to an exceptional gain on disposal of the company's ICULS amounting to RM24 mil that was recorded in QE31/7/05. Pre-tax profit was also negatively affected by the jump in finance cost (from RM0.6 mil to RM7.7 mil), which was attributable to higher bank borrowings used to finance its Second Capital Repayment.

Turnover for QE31/7/06 is 5.8% lower than the immediately preceding quarter (QE30/4/06)'s turnover because it had one draw less in QE31/7/06 and the preceding quarter had benefitted a higher seasonal sales due to the Chinese New Year festival in February. Despite the lower turnover, BJToto's pre-tax profit improved 9.4% q-o-q mainly due to a lower prize payout. Net profit is however 30% lower q-o-q due to the write-back of over-provision of tax in prior years of RM52.7 mil, which was done in the preceding quarter.

Valuation

Based on the EPS of 7.4 sen for QE31/7/06, we can estimate BJToto's full-year EPS to be about 29.6 sen. At yesterday's closing price of RM4.60, BJToto is now trading at a PE of 15.5 times. Unless there are more games being introduced that can lead to an increase in turnover, BJToto is almost nearing its fair value.

BJToto has been a stock that attracts a lot of income-seeking investors since it pays a very good dividend. Based on last year's dividend of 52 sen, BJToto has a yield of 11.3%!!! Can it sustain this level of dividend payout based on an earning of 29.6 sen?

Technical Outlook

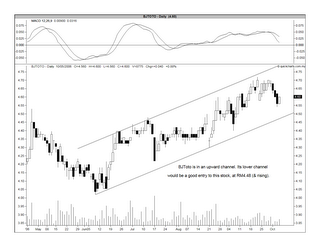

Based on the daily chart below, we can see that BJToto is in an upward channel. It is now in a minor corrective wave, which may see the stock coming down to test its lower channel line at RM3.48 (& rising). I believe this is a good level to buy BJToto. A break below this channel line would however be bearish for the stock.

Assuming the channel remains in tact, the stock may test the upper channel line at about RM4.90/5.00 on the next up-wave.

Chart 1: BJToto's daily chart as at Oct 5

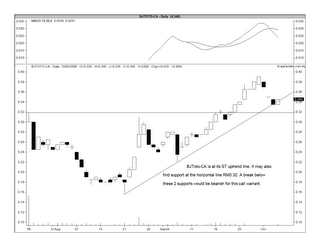

BJToto-CA's technical outlook

BJToto-CA has also declined in line with the drop in the price of the underlying share. It may test its short-term uptrend line at RM0.34. A break of that uptrend line may put it at the next support i.e. the horizontal line of RM0.32.

Chart 2: BJToto-CA's daily chart as at Oct 5

Conclusion

BJToto & BJToto-CA may be testing its uptrend line shortly. This may be a good buying opportunity as the share & call warrant would probably re-bound from the uptrend line. A break of the uptrend line would be bearish & in which case, you may want to exit your position until the technical outlook has recovered. This is a call based more on technical reasoning eventhough BJToto is a fairly attractive company, fundamentally.

No comments:

Post a Comment