Chart 1: Kenmark's 5-min chart as at May 31, 2010_10.10am (Source: Quickcharts)

There are two things to note:

1. The company is due to file its results for QE31/3/2010 today. Could there be a failure to file in its financial statement?

2. Looking at the last reported results for QE31/12/2009, we can note a few issues that are plaguing Kenmark. They are:

i) An outstanding legal judgment obtained by O-stable Sdn Bhd against the company in September 2009. The judgment sum payable was RM1.58 million. The company has filed an appeal against the court decision.

ii) The company has high bank borrowings, comprising short-term debts of RM88.8 million and long-term debts of RM53.4 million. While bank borrowings looks high, as a percentage of shareholders' funds, it stood at 0.4 times only.

iii) The company's trade receivables stood at RM248.7 million, representing 71% of Total Assets. Debtors turnover period stood at 350 days (based on annualized revenue of RM258.7 million). The debtors increased alarmingly over the past 3 years- by RM52.4 million in FY2008; RM36.6 million in FY2009; and RM87.4 million in 9-month ended 31/12/2009.

iv) For the 9-month ended 31/12/2009, Kenmark purchased Fixed Assets of RM45.2 million. This plus the increase in Debtors of RM87.4 million was financed by Trade Creditors of RM77 million, which increased by 306% from RM34.7 million to RM106.3 million.

I believe that Kenmark is now wrestling with the issue of the quality of its debtors. If half of the debtors are not collectible, Kenmark's shareholders' funds would drop to RM230 million. Its bankers & trade creditors- with amount owing of RM142.2 million & RM106.3 million respectively- may be feeling very uncomfortable now? For more on Kenmark's financial statement for QE31/12/2009, go here.

The above scenario raised the question on whether Kenmark can continue as a going concern. If this question was not in the investors' mind, then Kenmark appears to be trading at ridiculously cheap multiples, with Price to Book of only 5% or Price to Earning of 1.4 times (based on NTA per share of RM1.95 as at 31/12/2009 & annualized EPS of 7 sen).

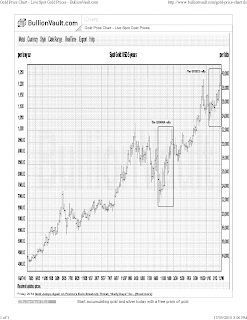

Technically, Kenmark is now trading at the all-time low. It has even surpassed the low of about RM0.45 recorded during the Asian Financial Crisis. The market action is screaming of bad times ahead for this stock.

Chart 2: Kenmark's month chart as at May 27, 2010 (Source: Tradesignum)

Technical analysts would caution against catching a falling knife. At 10 sen, many investors would find Kenmark to ignore. How low can it go, they may ask. That I cannot answer.

Latest Update

Kenmark Bhd was suspended this morning as news that its managing director, James Hwang, a Taiwanese, went absent without leave spread in the market. In addition, key company executives, including deputy general manager Goh Kim Chon as well as the finance and administration manager, have also resigned. For more, go here.