Chart 1: EURO's daily chart as at May 14, 2010 (Source: Stockcharts.com)

Chart 2: USD's daily chart as at May 14, 2010 (Source: Stockcharts.com)

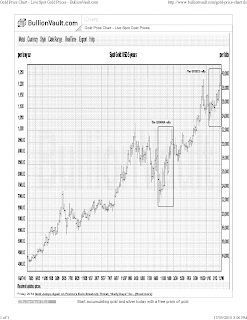

Another indicator of the flight to safety is the sharp rise in the price of gold. We have seen that in October 2008 to March 2009, and we are seeing that again since February this year (see Chart 3 below). Last week, gold price has surpassed the high of USD39000 per kg recorded in November 2009. Until a more workable or pragmatic solution is found to the problem of high government debts amongst developed nations in general and the PIIGS nations in particular, the financial markets will continue to be in bearish mode. For more on the problem of high debt among developed nation, go here. For more on the PIIGS nations' indebtedness, go here.

Chart 3: Gold's 5-year weekly chart as at May 14, 2010 (courtesy of Bullionvault.com)

1 comment:

Dear Alex,

There is a mild reversal for Both EURO/USD and GBP/USD Pair.

Euro/Usd is now traded at 1.2310-1.2320 ; Whereas GBP/USD is now traded near 1.4430,

There is also a mild reversal on Equity/Stock on Europe open, with approx. 1 % improvement on Average now.

These currency pairs' Reversal may last for sometimes and may be quite significant in view of the severe OVERSOLD status after a two-week sell off., Be prepared for the expected High Volatility.

Thanks for your Info.

Post a Comment