JTiasa is involved in the extraction of timber logs & further downstream processing of timber logs.

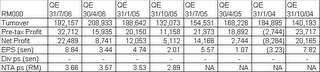

Recent Financial Results

JTiasa has just announced its result for QE31/7/06, which shows a sharply higher net profit of RN22.5 mil. This net profit is 157% higher than the preceding quarter's net profit eventhough the turnover has declined by 8.0% to RM192 mil during the periods under consideration.

When comparison is made with the results for the corresponding quarter last year, we noticed that the net profit has increased by 59% while turnover has grown by 24.4%.

Valuation

Based on the latest EPS of 8.84 sen for QE31/7/06, we can arrive at an annualized EPS of 35.36 sen. At the closing price of RM2.65 yesterday, JTiasa is trading at a PE of 7.5 times. This is not expensive and given the on-going timber play, I see JTiasa may go up higher.

Technical Outlook

JTiasa has just broken above its strong horizontal resistance of RM2.82/85. See the weekly & monthly charts below.

Chart 1: JTiasa's weekly chart as at Oct 11

Chart 2: JTiasa's monthly chart as at Oct 11

Conclusion

JTiasa is a laggard in the on-going timber play. It is fundamentally inexpensive and it has just turned technically bullish. At the time of making post, JTiasa has gone up 25 sen to RM2.90.

No comments:

Post a Comment