For this week, I have the following links for your reading:

1. In recent years, private equity funds have started springing up to cater for sophisticated wealthy investors. What these funds do- at outrageous fees- are to look for undervalued public companies, or promising new companies looking to go public, and buy them up at a price higher than the current stock-market price (sometime, at a premium of up-to-20%). These acquisitions are often financed by the issuance of junk bonds, at high interest rates. The new owners would often offer fat new pay packages to the managers of the company they've just acquired, to give them even greater incentive to maximize the value of the company, so it can be taken public again.

This development raises troubling questions about the fiduciary duties of public companies’ managers. Who do they owe their allegiance to: the existing public shareholders or the potential new owners? Read more about it

here.

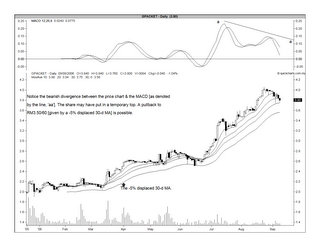

2. Most investors are fairly confused by the on-going market correction. Are investors disappointed with the recent Budget? Or, is it a case of “buying on rumor and selling news”? Well, it could be something simpler; something to do with the time of the year that we’re operating in. It seems that September has historically been “the most difficult month for stocks”. That’s the bad news. The good news is “the strongest upward bias in stocks has historically occurred during the November-January time frame”. Go

here for the chart that says it all.

3. Investing is hard. It requires a lot of hard work & discipline and a strong self-belief system. On top of all these, you need to have a fair dose of humility, that sometime you could still get it wrong. So, when someone comes along & starts to show you that

you can improve your investing skill by “paper-trading” as well as using tools of “back-testing”, you could be telling yourself “This is it! This is what I've lacked all these years.” Well, think again.

4. The Capital Spectator takes a look at a research paper published on the St. Louis Fed's web site entitled “

When Do Stock Market Booms Occur? The Macroeconomic and Policy Environments of 20th Century Booms”, which makes “a timely reminder that equity bull markets tend to thrive under a particular set of conditions…that appear to be on the wane these days”. "We find that booms generally occurred during periods of above-average economic growth and below-average inflation, and that booms typically ended when monetary policy tightened in response to rising inflation," write authors Michael Bordo (an economics professor at Rutgers) and David Wheelock (an economist at the St. Louis Fed). "Most booms were procyclical, arising during business cycle recoveries and expansions, and ending when rising inflation and tighter monetary policy were followed by declining economic activity.” Read more about

here.

5. Despite the positive price action in the US equity market, Contra Hour still remains "cautiously pessimistic". Why? Read about it

here.

6. Bob Bronson of Bronson Capital Markets Research shares the same view. Read about it

here.

7. From

Hello Trader, we have

a set of 12 trading rules

to guide you in your trading:

Rule # 1: Let your winners run, cut your losers short

Rule # 2: Don’t add to losing positions

Rule # 3: Don’t fight the trend / tape

Rule # 4: Buy strength and sell weakness, not the other way around.

Rule # 5: Trade your personality

Rule # 6: Plan your trade and trade your plan

Rule # 7: When the reason for entering a trade is no longer valid, get out

Rule # 8: Don’t be the weak money

Rule # 9: Keep a trade diary

Rule # 10: Never risk more than 5 percent of your account equity on a trade

Rule # 11: Risk a fixed percentage of capital on every trade

Rule # 12: Focus on market selection

That's all for this week. Have a good weekend.