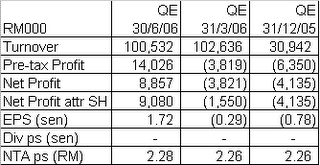

So far, we have only 3 quarterly result announcement from TWSPlnt. As the merger was completed in Feb, the only meaningful results is that of QE30/6/2006. In that quarter, the company recorded a net profit of RM9.08 million on the back of a turnover of RM100.5 million.

In a recent report in November, K&N Kenanga has projected net profit & turnover for FY2006 of RM75.3 million & RM476.5 million, respectively for TWSPlnt. EPS for FY2006 was estimated to be 12.0 sen.

Based on the closing price as at the end of the morning session of RM2.06, TWSPlnt is trading at a PE of 17.2 times. That's about the average PE for a plantation company, currently.

Chartwise, TWSPlnt appears to be in an ascending triangle, with breakout at RM2.03. Its recent high was RM2.08 recorded on May 8. The share has been pressing against the breakout level for the past few days. Today, it has broken above the breakout level of RM2.03 and it has gone as high as RM2.09 i.e. surpassing the recent high of RM2.08. It is very likely that a genuine breakout is in hand & TWSPlnt is now a trading BUY.

No comments:

Post a Comment