Call warrants have continued to rise. When you compared call warrants' premium as at today with that of November 24 (last Friday), you would notice that the average premium have increased from 9.7% to 11.3%. Because of the increased premium, call warrants' prices have increased by an average of 8.8% from November 24 while the underlying share prices have declined marginally by 0.2% during the same period (see Table 1 below). I believe that the call warrants' premium is not excessive as we are still in the early days of a bull rally (notwithstanding my earlier post on the possible upcoming correction). I have heard (with disbelief) fellow remisiers forbidding their clients from buying call warrants on the ground that their rise are unsustainable & prompt to failure!

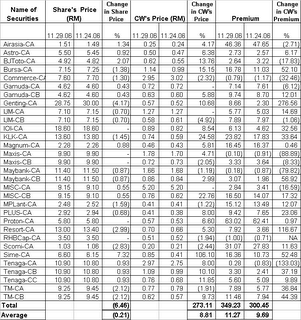

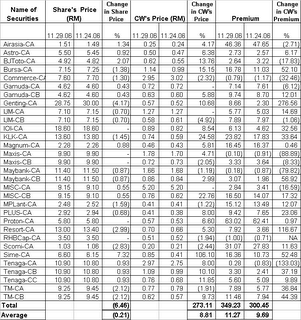

Table 1: Changes in Call warrants' prices, underlying share prices & premium from Nov 24 to 29

Table 1: Changes in Call warrants' prices, underlying share prices & premium from Nov 24 to 29I have also posted below the usual Call Warrants update for your easy reference. The cheap call warrants are highlighted in yellow while 2 call warrants that due to expire in January 2007 (i.e. Astro-CA & Scomi-CA), have their expiry dates highlighted in pink. To be fair, I'm not too disturbed by the upcoming expiry of Astro-CA as it is trading within the money. It is Scomi-CA that you must avoid as it is trading outside the money.

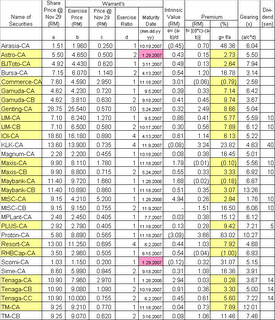

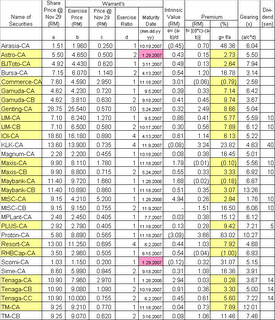

Table 2: Call warrants' intrinsic value & premium as at Nov 29

Table 2: Call warrants' intrinsic value & premium as at Nov 29

2 comments:

Hi Alex,

Sorry about the previous comment deletion...commenting for the first time having some trouble figuring this out...

Anyway, I started reading your blog recently. Find it very interesting and informational, thank you. I am especially intrigued by your posts on call warrants. Been dabbling in equities but only recently got interested in warrants. Good local focussed info on these instruments are hard to come by, so finding your blog is a bonus.

Got a question from reading your post on IJM warrants that I hope you can explain a bit further: can you give an example of a "cash-settled" transaction in exercising a warrant? Do I need to pay the exercise price for the warrant and only then sell the acquired shares to realise the differential price gains between underlying and exercise price(eg. for the "peculiar" IJM example that you posted earlier?)

Thanks!

Post a Comment