The sale of the controlling stake in the manufacturing operations may be based on a similar model currently in place between the second national carmaker, Perodua & its principal, Daihatsu Motor Co Ltd of Japan. Under this arrangement, the domestic distribution arm will remain in Proton's domain but the manufacturing operations will be managed by the forien party.

This unconfirmed report may be the catalyst that drove the share price of Proton up 54 sen to RM5.20 yesterday. At 11.00 a.m. this morning, Proton's share price has gained another 40 sen to RM5.60.

Assuming that this report is credible, two things must be noted. First of all, the sale is not a sale of 51%-stake in Proton itself but its manufacturing operations. So, there will be no MGO for Proton's minority shareholders. Secondly, the sale of this stake will definitely lead to greater utilization of the currently under-utilized Proton's manufacturing capacity & this will quickly lead to an improvement in Proton's bottomline. In the near future, other benefits will flow in such as the sharing of technical expertise, the development of new models on same platforms etc. So, this is a positive development but it may not be as good as what some people had hoped for. We are not going in the direction of Volkswagen's taking over the driving seat in Proton like what has happened in Seat or Skoda.

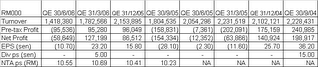

For details of Proton's deteriorating financial performance, see the table below.

Proton's share price has broken above its downtrend line in September. Despite the breakout, the price did not move up. Instead, it was drifting down to do a 'Test-of-the-Low' i.e. to test its low of RM4.50 in August. Yesterday's sharp rise has put the share price at the resistance of RM5.20. This morning, the share price has gained another 40 sen & thereby breaking above the RM5.20 resistance (as well as another resistance at RM5.50). Proton's next resistances will be at RM6.10 & RM7.00. See the weekly chart below.

Chart: Proton's weekly chart as at Nov 8

Conclusion

After a sharp 2-day rise, I believe that Proton is likely to take a breather. If the share price were to drift back to the RM5.20 level, I believe that could be a good entry to this stock.

No comments:

Post a Comment