Astro-CA (closed at RM0.21 as at September 25) is the call warrant of Astro (closed at RM4.98 as at September 25). 28 mil Astro-CA was issued at an issue price of RM0.225 on May 22, 2006 by CIMB. The call warrant has an exercise price of RM4.65; an exercise ratio of 2 warrants for 1 share; & will expire 8 months from the date of issue.

Technical Outlook

Astro-CA has broken out of its trading range of RM0.145 & 0.18 on the upside on September 21. It went to a high of RM0.26 the following day. It is now in a correction phase. As long as it can stay above RM0.18, the breakout is valid & this could potentially lead to further upside for this call warrant.

Chart 1: Astro-CA's daily chart as at September 25

Astro’s recent financial performance

Astro has recently announced its results for QE 31/7/06. Its turnover increased by 8.8% q-o-q or 14.0% y-o-y to RM569 mil. The increased turnover was attributable to higher subscription revenue from the TV segment (with subscribers’ base increasing from 1.76 mil as at 31/7/05 to 1.99 mil as at 31/7/06) as well as higher advertisement revenue from both the TV & radio segments.

Net profit of RM73.0 mil is higher than the net profit of RM66.0 mil reported in the same quarter last year but lower than the preceding quarter’s net profit of RM90.5 mil. The higher net profit for QE30/4/06 was partly due to the reversal of accruals of RM19.9 mil in relation to the cost of set-up boxes. Meanwhile, net profit has continued to grow due to improved EBIT margin (due to lower subscriber acquisition cost) & higher interest income; which were offset partially by losses from its Indonesian venture of RM15.2 mil (see the Table below).

Technical Outlook of Astro share

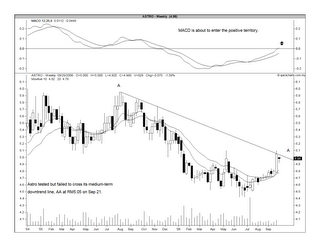

From Chart 2 below, we can see that Astro is still in a medium-term downtrend with resistance at RM5.05. The recent share price run-up saw a failed test of this downtrend line on September 21.

Chart 2: Astro's weekly chart as at September 25

Conclusion

Over the next few days, we can expect Astro-CA's price to consolidate like the price of Astro share. As long as the price of the call warrant can remain above the RM0.18, a recovery in the price of the share is likely to lead to quick improvement in the price of the call warrant.

As always, any investment in call warrants has to be tracked regularly and if it doesn't work out as envisaged, you must be prepared to sell off this investment quickly before further loss in value due to the passage of time. This call warrant will expire in January 2007.

No comments:

Post a Comment