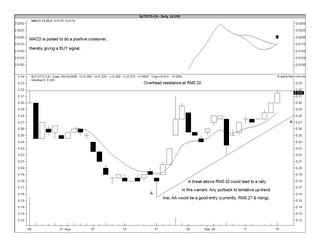

From Chart 1 below, we can see that the price of BJToto-CA has touched its high of RM0.32 recorded on its first day of trading on July 24. BJToto-CA would be considered technically bullish if it can surpass the RM0.32 level convincingly.

Chart 1: BJToto-CA's daily chart as at September 18

However, I must point out that one of the possible reason for BJToto (the underlying share)'s current strength could be the upcoming dividend of 12.5 sen, which will go "ex" on September 22. As a result of the rise in the underlying share, the call warrant has also risen accordingly. Unfortunately, the holders of the call warrant are not entitled to any dividend.

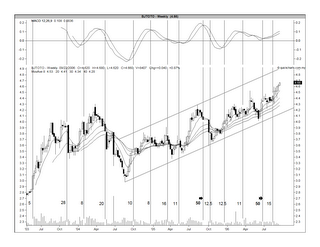

From Chart 2 below, you will see the track record of BJToto's dividend payment for the past 3 years noted down at the bottom of the price chart. You may note that BJToto has paid out dividend totaling 46 sen for calender year 2004; 52 sen for calender 2005; and 25 sen for the year todate. In addition, it has also made 2 capital repayments of 50 sen each; once in Sep 2005 & again in July 2006.

Chart 2" BJToto's weekly chart as at September 18 (with dividend payments [in sen] noted at the bottom of the chart)

Many analysts are calling a BUY on BJToto because of its steady stream of dividend. Based on last calender year's dividend of 52 sen, the stock's dividend yield is 11.16% (using yesterday's price of RM4.66).

It is noticeable that the call warrant of an underlying share that pays good dividend would normally trade at very little premium. The reason could be because investors tend to prefer the underlying share to the call warrant. The same can also be observed in BJToto-CA, which trades at a premium of 1.8% only. Nonetheless, a call warrant would move in the same direction (or, trend) like that of the underlying share.

The recommendation for BJToto-CA is strictly based on technical consideration & for trading purposes only. If you are worried that the current technical set-up may have been skewed by the upcoming dividend payment, then you should wait until the dividend payment's ex-date has passed before committing. As always, any investment in call warrants has to be tracked regularly and if it doesn't work out as you have envisaged, you must be prepared to pull the plug fast to prevent further decay due to the passage of time.

No comments:

Post a Comment