Chart: Bandaraya's daily chart as at Sep 12

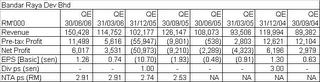

Bandaraya has announced its financial result for QE30/6/06 recently. Its net profit has increased by 70% q-o-q to RM6.0 mil on the back of a 31%-increase in turnover to RM150.4 mil. The improved net profit is attributable to the higher sale of its property division as well as its chipboard manufacturing division (carried on by Mieco). See the table below for Bandaraya's last 8 quarterly result.

Based on the annualized EPS of 5.04 sen (using the EPS for QE30/6/06) & the closing price of Sep 12 of RM1.05, Bandaraya is now trading at a PE of 21 times. While this PE multiple looks high, I believe that it is likely to drop to a more moderate level due to the turnaround in Mieco & the good sale of its new property launch in Bangsar (known as "One Menerung"). Also, you may notice that the share is currently trading at a Price to Book of 0.34 times only. So, take a look at Bandaya.

No comments:

Post a Comment