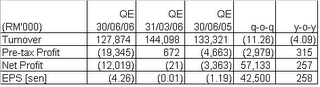

Table 1: Courts' quarterly results for QE30/6/2006 compared

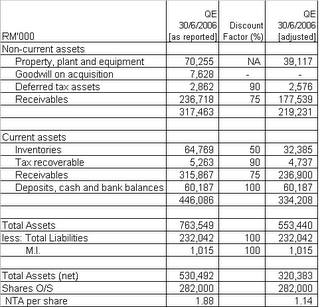

As noted in my first post on Courts, the proper valuation method to adopt is the break-up valuation. I've re-evaluated Courts again using the latest balance sheet as at 30/6/2006. Despite the poorer result, the fair value is about the same at RM1.14 per share (see Table 2 below).

Table 2: Courts' value as per break-up valuation method

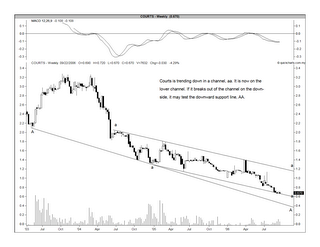

Technical outlook

As noted in my second post on Courts that a break of the then-prevailing horizontal support of RM0.80/82 could lead to lower prices. This has indeed happened. A look at the weekly chart (Chart 1) shows that Courts is now at the lower boundary of a downward channel. This boundary should support the share price at RM0.65 level. A break of the downward channel could see the share price going to the long-term downward support line at RM0.45. I see this scenario as not likely & that the channel should hold.

Chart 1: Courts' weekly chart as at September 19

Chart 2: Courts' monthly chart as at September 19

Conclusion

The share is now trading at RM0.67, which is at a discount of 41% to the fair value (of RM1.14) derived from our break-up valuation. The latter is approximately 60% of the NTA per share (of RM1.88) based on Courts' latest balance sheet as at 30/6/2006. An investment at this level is fairly safe as it is a deep discount to the current NTA of the share.

Finally, a decision is expected soon regarding the disposal of Courts plc's majority stake in Courts Mammoth. This disposal would almost certainly lead to a MGO at the transaction price that will be agreed between Courts plc's administrator & the buyer.

No comments:

Post a Comment