On Friday, I have posted a comment that if the CI can close above the 20-week MA (wrongly stated as 20-day MA) at the level of 923, we may consider the test of the low as successfully completed and a recovery may be at hand. With the Friday close at 924.72, this condition has been satisfied eventhough the volume of shares traded and the market breadth are not too convincing.

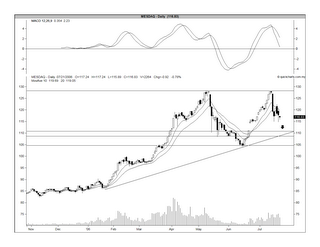

The market that will worry traders in the next week or so will be Mesdaq. A consolidation is underway after the Mesdaq index did a double top at 128 on July 13 (see the Chart below). I have noted in a post dated July 12 entitled "What's up with Mesdaq?" that the Mesdaq is about to do a double top & then, consolidate. To wit:

"My feeling is that the first attempt at the 128-130 levels, which may happen in the next 2 or 3 days, is unlikely to succeed. Why do I think so? I believe that Mesdaq's current rally at the present pace is unsustainable. The 128-130 levels would be a good point for Mesdaq to take a pause. The Mesdaq may pullback to the 120 horizontal support level or even to the 110 uptrend line support before re-testing the 128-130 levels later..."

Chart: Mesdaq's daily chart as at July 21

Since the 120 level was broken, Mesdaq is now on the way to test the supports of 111 (the low end of the gap-up that happened on June 22) and 108/109 levels (horizontal & uptrend line supports). A break below the 108/109 levels would mean that Mesdaq's consolidation would last much longer. It may drop to the 105 support level, which is the low recorded during the May/June correction. Thereafter, the next support level would be the strong psychological level of 100. Hopefully, the Mesdaq's consolidation would not be too bloody and does not break below the 108/109 level.

No comments:

Post a Comment