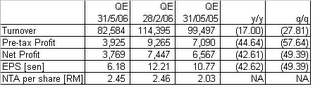

Table 1: Suiwah's 4Q2006, 3Q2006 & 4Q2005

If we compare Suiwah's performance in FYE 2006 against its FYE 2005 (see table 2 below), we can see 2 reasons for the drop in the net profit. Firstly, turnover from retail trade has increased by 3.7% while operating profit has declined by 2.7%. This means the retail's profit margin has dropped due to competitive pressure. Secondly, the manufacturing division's operating profit has also dropped by 18.4%, which is in line with the 19.0%-drop in turnover. This division, which is carried on by the Qdos group that manufactures Flexible Printed Circuit Boards (FPCs), had experienced some disruption in output in the 3Q2006 & 4Q2006 due to the upgrading work carried out in its manufacturing facilities. The upgraded manufacturing facilities would enable Qdos to produce higher margin FPCs.

The main concern for Suiwah going forward is that the competition in the retail sector could only worsen due to recent government's decision to lift the freeze on the opening of hypermarket at the end of 2006, which is 2 years ahead of its original deadline.

Table 2: Suiwah's FYE 2006 & FYE 2005

Assuming that the manufacturing division bounces back & contributes more to Suiwah's bottomline i.e. more than enough to offset any drop in contribution from the retail division, than the earning of the group would not suffer. The EPS for 2006 amounts to 38.2 sen. With the tougher outlook for the retail sector & possible teething problems in the manufacturing division, we may want to adjust the 2007 EPS downward by 20% to 30.6 sen. Based on yesterday (July 27)'s closing price of RM2.01, the stock will be trading at 6.6 times our future earning. It is still not expensive and, given the nice technical set-up i.e. the share price is sitting on a very long-term uptrend line at RM2.00, I would keep my BUY call for Suiwah. I would still maintain that a stop loss of RM1.90 should also be set if you have bought this stock.

No comments:

Post a Comment