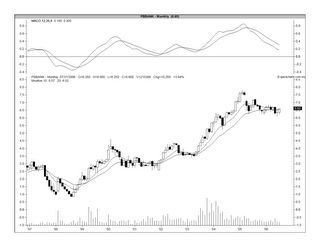

PBB has been consolidating for the past 17 months i.e. after making a high of RM7.80 in the week ending Feb 18, 2005. The pattern of the share price consolidation takes the shape of a descending triangle, with the base at RM6.20. Since the 2Q 2006 result annoucement on July 20, the share price has broken above the declining overhead resistance at the RM6.55 level. If the share price can hold above the level for another day or so, the stock would have a bullish breakout (see Chart 1 below). You can see that the weekly MACD is also poised to do a positive crossover.

Chart 1: PBB's weekly chart as at July 20

I have also attached PBB's month chart (Chart 2 below) to show how the stock has performed in the past few years. The stock made a low of RM0.80 in August 1998 and since then, it has been on a steady uptrend until its Feb 2005 high of RM7.80. By plotting the 10- & 20-week MA, we can see that the current consolidation is nearing its completion.

Chart 2: PBB's monthly chart as at July 21

Finally, I would also like to point out that PBB has 2 quotations i.e. PBB and PBB-01; the former is a local share while the latter is a foreign share. Due to current poor sentiment, PBB & PBB-01 have been trading at about the same price. In fact, PBB & PBB-01 closed at RM6.60 & RM6.50 respectively, on Friday (July 21). In a bullish period, when foreign funds want to invest in PBB, they will only buy PBB-01 because their mandates require them to buy only stocks that give them a voting right i.e. PBB-01. During such period, they will bid aggressively for PBB-01. In the past, this has led to buyers offering a premium for the foreign shares, PBB-01. At the peak of the PBB share price over the past 5 years, the premium offered are RM0.40 for w/e Feb 28, 2005 [RM8.20 cf. RM7.80]; RM0.74 for w/e Jul 31, 2002 [RM5.12 cf. RM4.38]; and RM1.13 for w/e Feb 29, 2000 [RM5.76 cf. RM4.63]. The monthly chart for PBB-01 is shown below as Chart 3.

Based on the above, PBB looks like a BUY. I prefer PBB-01 to PBB for reason stated above.

Chart 3: PBB-01's monthly chart as at July 21

No comments:

Post a Comment