Java Inc Bhd (“Java”) is involved in the extraction of timber logs and the downstream activities of manufacturing of wood-based products. This timber operation is located in Sabah, where the group has 2 designated timber concession areas situated into: (1)Kalabakan Forest Reserve, Tawau [measuring approximately 25,000 hectares] and (2)Sungei Pinangah Forest Reserve, Keningau [measuring approximately 6,000 hectares].

Java will be venturing into the cultivation of oil palm in Kelantan when it has completed its acquisition of RSJ Trading, which has signed a 80:20 JV to cultivate oil palm on a piece of land measuring 3,120 acres in Jeli, Kelantan.

Java is the restructured successor of Aokam Perdana. Under the Restructuring Scheme completed in Dec 2004, Java acquired Key Heights (an investment company which owns subsidiaries that are involved in the timber business in the State of Sabah); implemented a 20-to-1 capital reduction; and, undertook a debt-for-share swap, a Right Issue & a Special Issue. After the completion of the Scheme, Java’s ordinary share capital increased to RM141.76 mil. At the same time, it had also issued 23.5 mil ICCPS (or, Preference Shares) and 24.60 mil warrants. Since then, 2.7 mil of the ICCPS had been converted to ordinary shares & as at today, Java’s ordinary shares stands at RM144.46 mil.

Recent Financial Performance

Java has recently announced its results for FYE2006. For the full year, Java’s net profit has declined by 50.8% to RM25.2 mil, which was achieved on the back of a 22.2%-increase in turnover to RM262 mil. The drop in net profit is attributable to an exceptional gain of RM38.6 mil recorded in FYE2005, which resulted from the write-back of provision brought about by the Restructuring Scheme. If this gain is excluded, the net profit has actually improved by 99.6% from RM12.6 mil to RM25.2 mil. I have tabulated Java's past 8 quarterly result in Table 1 below.

Table : Java's 8 quarterly results

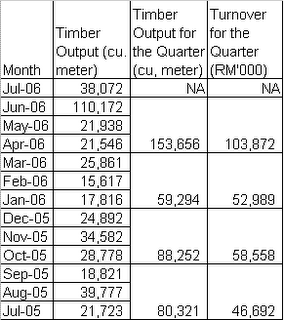

The latest 4Q2006 results show strong improvement in turnover & net profit. Net profit has increased 143% q-o-q or 123% y-o-y to RM13.6 mil on the back of a turnover of RM103.9 mil, which has increased by 96.0% q-o-q or 44.8% y-o-y (see Table 2 below). The good result can be traced to a sharp jump in timber output for the month of June 2006. In that month, timber output was recorded at 110,172 cubic meters, which is almost 3 &1/2 times the average monthly output for FYE2006. The subsequent month of July 2006 saw the output dropped back to 38,072 cubic meters (see Table 3 below). This gives rise to concern that the good result for 4Q2006 may not happen again.

Table 2: Java's latest quarterly results compared.

Table 3: Java's timber output from Jul 2005 to Jul 2006

Valuation

Since there is some doubt as to whether the 4Q2006 performance can be repeated, we shall use the 3Q2006 result as the basis for computing Java's 2007 EPS, which gives an EPS of 15.12 sen. This is deemed conservative since the price of timber logs has firmed up further since 3Q2006. Nevertheless, basing on this figure & Java's closing price at August 30 of RM0.685, Java's PE is only 4.53 times. This compared favorably to its bigger peers like WTK (with PE of 16 times) & Ta Ann (with PE of 13 times). The low PE for Java is probably due to its recent history of being a distressed company. Also, the share may suffer from selling pressure from its former creditors, who were given shares in exchange for debts.

Technical Picture

The chart below shows that Java has been bottoming out since Mar 2006. To go higher, it must surpass the RM0.69/0.70 level convincingly.

Chart: Java's daily chart as at August 30

Recommendation

Java looks like a good Trading stock since it is relatively cheap. Being a timber stock, it may also benefit from the current theme play.

No comments:

Post a Comment