One can say that Carotec was the first company for which the share price has gained substantially due to its involvement in the Biofuel sector, thus benefitting from the recent Biofuel theme play (see Chart 1 below).

Chart 1: Carotec's weekly chart as at Sep 8

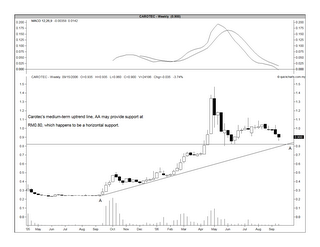

The share price has been consolidating since the May & June selldown. From Chart 2 below, you will notice that the consolidation will only come to an end once the price has broken out of the symmetrical triangle pattern that the share is currently trading in. This morning, the share has broken out of that pattern on the downside [breakout level: RM0.92] when it dropped to a low of RM0.865 at 9.50 a.m. At the time of writing this post [at 11.45 a.m.], the price is at RM0.88. Unless a recovery happens swiftly & the price can recover back to the RM0.92 level, the technicians would view this as a SELL signal.

Chart 2: Carotec's daily chart as at Sep 8

Update made on September 13

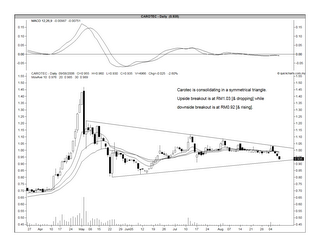

After further study of Carotec's weekly chart, I would revise my assessment of the stock's outlook slightly. The short-term outlook remained unchanged i.e. bearish. Medium-term outlook is still good as its uptrend is still in tact. Only when the share price has broken below RM0.80/82 level would the uptrend line be broken (see Chart 3 below).

Chart 3: Carotec's weekly chart as at Sep 13

No comments:

Post a Comment