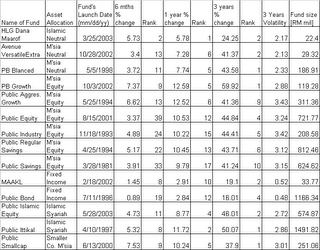

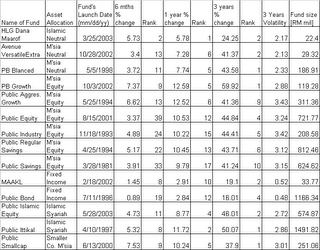

I've looked through the Standard & Poor's Fund Services' weekly table tracking the performance of unit trusts as at August 25, 2006. Something interesting caught my eyes. If you look at the 14 funds that are rated 5-star i.e. the top 10% of their respective sector (see the Table below), you would discover that 11 of them are managed by Public Mutual Funds Bhd. These 11 funds are fairly well distributed in many sectors (or, classes of assets), such as Malaysia Neutral (Equity & Fixed Income), Malaysia Equity, Fixed Income, Islamic Syariah & Smaller Companies Malaysia. Some of the funds were launched long ago, such as Public Savings (launched in March 1981) & some are fairly recent, such as Public Islamic Equity (launched in May 2003).

The out-performance of Public Mutual Funds is even more glaring when you look at the other 3 funds rated 5 stars; they consist are one fund each from MAA, Avenue & HLG. Without doubt, Public Mutual Funds is way, way ahead of its competitors. So, the next time you look for a fund to invest your money, try to pick one from Public Mutual Funds.

Table of Fund's performance as at August 25 from S&P's Fund Services

Table of Fund's performance as at August 25 from S&P's Fund Services

No comments:

Post a Comment