The current boom in the oil palm sector should benefit CBIP considerably. The financial performance of CBIP for the past 5 quarters is fairly good (see Table below).

The share has broken above the strong resistance of RM2.90 level at 9.30 a.m. this morning. At 4.00 p.m., the stock has also broken above the RM3.00 psychological level (see Chart 1 & 2 below). The breakout at RM2.90 is very bullish for CBIP as it represents the continuation of the prior uptrend. Measuring the low of the preceding continuation pattern i.e. RM2.40 and the breakout point of RM2.90, I believe that this current uptrend rally is likely to have a target objective of RM3.40 (RM2.90 + RM0.50).

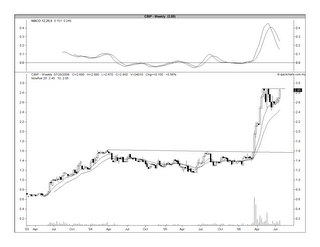

Chart 1: CBIP's daily chart as at July 28

Chart 2: CBIP's weekly chart as at July 28

Updated on 8/1/2006

S&P's result report dated May 31, 2006 has forecasted that CBIP might record a net profit of RM26.4 mil on a turnover of RM240.0 mil for FYE2006. For FYE2007, net profit was forecasted to increase to RM38.3 mil while turnover would grow to RM308.1 mil. Based on this, EPS for 2006 would be about 19.8 sen (as compared to 14.9 sen for 2005). As such, CBIP (which closed at RM3.02 yesterday) is now trading at a PE of 15.3 times its current year's earning. Some may view the stock as fairly valued notwithstanding the net profit's high CAGR of 30-40% for the next 2 years.

No comments:

Post a Comment