Juan Kuang (M) Industrial Bhd (“Juan Kuang”) is a Second Board company that is involved in the manufacture & supply of wiring harness systems (for motor vehicles) and auto accessories as well as being an importer & wholesaler of electrical products & access.

Past Financial Performance

From the above, we can see that Juan Kuang has done a turnaround in FYE 31/1/2005. This is quite a change from a net loss of RM13.6 mil in FYE 31/1/2003 to a net profit of RM12.2 mil in FYE 31/1/2006. This was achieved on the back of a turnover that has increased at a compounded rate of about 25% per annum in the past 3 years.

Current Financial Performance

If you compared the last 4 quarterly results with the preceding 4 quarterly results, you can see that turnover has increased by 33.6% from RM 166.8 mil to RM 222.9 mil. Unfortunately, net profit declined 2.9% from RM 15.0 mil to RM 14.6 mil. EPS has similarly dropped marginally from 28.36 sen to 27.53 sen. The decline in profitability has been attributed to increased raw material cost which Juan Kuang has not been able to pass on to its customers.

Valuation

Based on the closing price as at July 5 of RM1.10, the stock is trading at a PE of 4 times or 0.8 times its book value. This is fairly cheap.

Technical Outlook

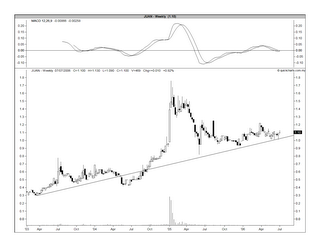

The chart below shows that the stock is in a gradual uptrend. An imperfect “uptrend line” has been drawn and, from it, we can see that the RM1.00 levels should been a strong support. [The uptrend line drawn has ignored the poor prices during the June to August 2004 period.]

Juan Kuang’s weekly chart as at July 5, 2006

Future Prospect

Juan Kuang has carried out a big expansion program in January this year which has doubled the size of its production floor area. This new factory, which has been leased from Tzel Assets Sdn bhd, has increased the production floor area by 137,072 sq. ft. from the existing area of 142,990 sq. ft. It is used for the production wire harness systems. With this expansion, the turnover should increase by about 20-30% this year.

Weaknesses noted

The main weaknesses noted are:

• Juan Kuang has not paid dividend in the past 4 years.

• The stock has very low trading volume.

Recommendation

Based on cheap fundamental valuation & fairly good technical outlook, I would recommend a BUY for Juan Kuang at a price between RM1.00-1.10 levels.

No comments:

Post a Comment