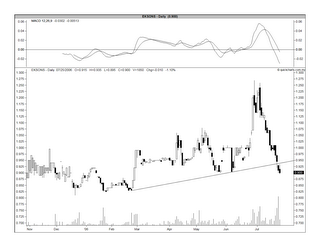

On Monday (July 24), Eksons dropped below the RM0.95 uptrend line to close at RM0.91. Yesterday (July 25), it dropped another 1 sen to close at RM0.90 (see Chart 1 below). The stock dropped another 4 sen to close this morning session at RM0.86. In my earlier post, I've written that if this stock dropped below the RM0.90, the BUY call shall cease and any stock accumulated should be disposed off. This view shall remain.

Chart 1: Eksons' daily chart as at July 25

However, if you choose to hold the opposite view, I shall show you that the downside risk is not excessive. From Chart 2 below, you can see that the long-term uptrend line support is at RM0.85. If this also failed, the next support will be the horizontal support of RM0.80/0.83.

Chart 2: Eksons' weekly chart as at July 25

No comments:

Post a Comment