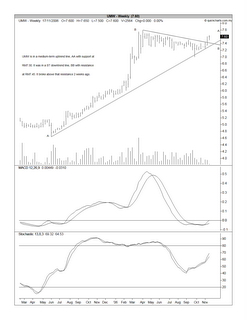

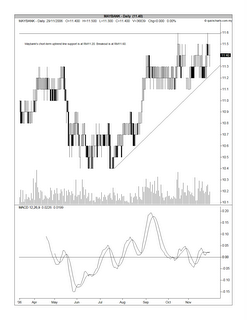

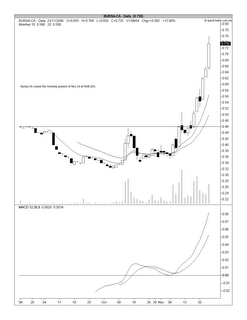

Chart 1: Maybank's daily chart as at Nov 29

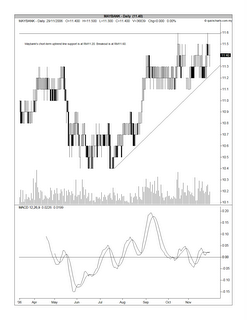

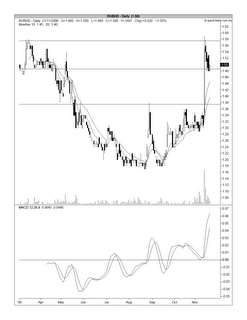

Chart 2: TM's daily chart as at Nov 29

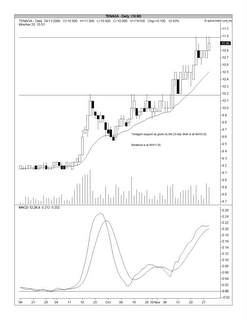

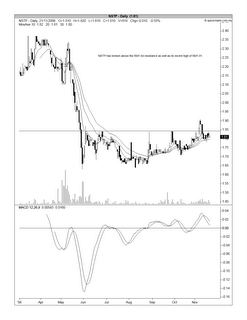

Chart 3: Tenaga's daily chart as at Nov 29

This is a personal weblog, reflecting my personal views and not the views of anyone or any organization, which I may be affiliated to. All information provided here, including recommendations (if any), should be treated for informational purposes only. The author should not be held liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein.

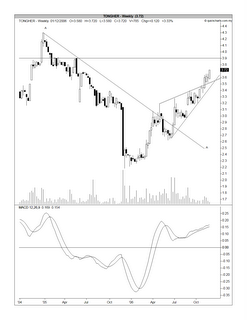

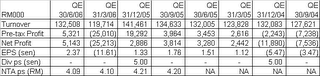

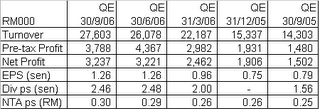

Due to the sharp rise in net profit, Tongher's EPS for QE30/9/2006 is at 24.39 sen. If this earning can be maintained going forward, Tongher's EPS for full-year could be as high as 97.56 sen. At 3.00 p.m. (November 29), Tingher is trading at RM4.00. At this price, Tongher's PE is about 4.1 times, which is still relative inexpensive.

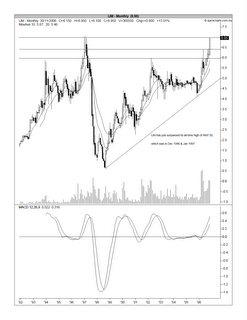

From the weekly chart below, you can see that Tongher has broken out of its rising wedge at RM3.50 level in October. The next resistance was RM3.90, which was broken today. Tongher could revisit its high of RM4.30 recorded in December 2004.

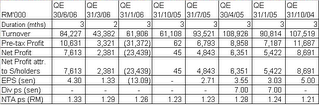

Maxtral’s last 4 quarters’ net profit amounted to RM14.9 million, which is double that of the preceding 4 quarters. Turnover has increased by 49% from RM130.5 million to RM194.7 million during the same periods. Consequently, its EPS for the last 4 quarters increased by 110% to 7.04 sen from 3.36 sen previously.

The technical picture for Maxtral is quite attractive. The stock has recently surpassed its April high of RM0.39. With this breakout, the stock may rally upward in line with the other timber stocks.

Chart 1: IJM's monthly chart as at Nov 23

Before we proceed further, let’s recap some outstanding significant corporate exercises that may have impact investors’ opinion on IJM. A few weeks ago, IJM has proposed to takeover of Road Builders in a deal which effectively swaps 2 Road Builders shares for 1 IJM new share. In addition, the market is also awaiting the confirmation of IJM’s acquisition of a stake in Kumpulan Euro, with the stumbling block being the finalization of the latter’s concession agreement with the State Government of Selangor regarding the development of the

As a technical rule, a stock that has made a new high has the tendency to continue to go higher. As such, IJM could be in for a very interesting time. Having said that, I like to introduce you to another technical rule; one that’s not so well-known. In the book, Trader Vic - Methods of a Wall Street Master, Victor Spenrandeo has made this observation: “In an uptrend, if a higher high is made but fails to carry through, and then prices drop below the previous high, then the trend is apt to reverse." That’s something that we must watch out for in the next few trading days- whether IJM share price may slide back below the RM7.05 level.

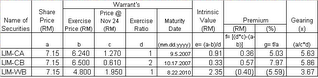

The big question is how do you gain entry into this developing play, besides buying into IJM. You can do anyone of the following:

Buying Road Builders to ride on IJM's rise is relatively safe since the IJM-Road Builders deal, being a friendly deal, is likely to be completed. As the Road Builders share shall be exchanged for IJM share at a ratio of 2:1, you should buy Road Builders at a price not exceeding RM3.55. In fact, you should build in a discount of 3 to 5% to take into account of the risk of the IJM-Road Builders deal may somehow falter.

Here, we have a very strange situation of IJM-WB trading at a discount of 40 sen or 5.6%. This doesn’t seem right. It gives rise to a situation where one can simply buy IJM-WB & exercise the conversion option by paying the exercise price of RM4.80 & thereafter disposing off the share at a profit of RM0.40 [IJM price of RM7.15 less (IJM-WB price of RM1.95 plus exercise price of RM4.80)]. In fact, the volume traded last Friday of 76,245 lots (or, 7.6245 million units) indicates that some investors may have spotted this discount & were buying quite substantially. The question is why are the sellers so willing to sell at a discount? In the past, I have noticed that such anomalies could persist for sometime, say a few days or even a few weeks. The longer this discount persists, the greater is the chance that the share price will correct. This is only natural as demand (for the share) will eventually be fulfilled by unending supply as more shares are created due to the investors’ exercising their warrants (i.e, IJM-WB) for new shares.

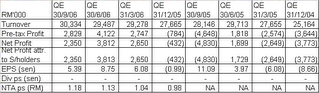

So, over the next few days, watch out for IJM share price as well as IJM-WB price. If IJM share price drop below RM7.05 or the discount persist for IJM-WB, you are forewarned that this 'new high' may not sustain.Yoko has just reported its results for QE30/9/2006 which shows a net profit of RM2.35 mil, which is a substantial improvement over a net loss of RM4.8 mil recorded in the previous corresponding quarter. Turnover for QE30/9/2006 of RM30.3 mil is 7.8% higher than turnover in QE30/9/2005. Current net profit is however 38.4% lower than the immediate preceding quarter’s net profit of RM3.8 mil. This is attributable to the recognition for the gain on disposal of a subsidiary in France of RM3.1 mil during the last quarter.

EPS for the first 3 quarters amount to 19.23 sen vis-à-vis an EPS of only 0.32 sen for the same periods last year. If we exclude the non-recurring exceptional gain of RM3.1 mil from the disposal of the subsidiary in France, the EPS would be lowered to about 12 sen. Annualizing this, we can arrive at a full year EPS of 16 sen for Yoko. Based on the clsoing price of RM0.555 as at November 24, Yoko is now trading at a PE of about 3.5 times only.

From Chart 1 below, you can see that Yoko may have just broken above its horizontal resistance of RM0.55. This followed the break above its 200-day Simple Moving Average (SMA) of RM0.48 at the end of October. You may also notice that the 50-day SMA has also crossed above the 200-day SMA. For a chart with a longer time frame, go to Chart 2 below.

Based on attractive valuation & potentially bullish technical outlook, Yoko is a stock good for a medium-term trade or for the long haul.

If you look at the mother share's chart (see Chart 2 above), you will see that the share has been pressing against the RM7.00 level. A break above this level could be the start of another bullish move that may bring Bursa to its recent high of RM7.65. At the time of writing this post, Bursa is at RM7.05.

Chart 2: RUBhd's daily chart as at Nov 21

After the big price move mentioned earlier, RUBhd share price has retraced back to RM1.48. Today, it has begun to move up again. The share closed at RM1.56 at the end of the morning session, gaining 6 sen on a volume of 4,276 lots. At this price & assuming a full year EPS of 79.52 sen, RUBhd is trading at a PE of 2.0 times only. Hard to believe…

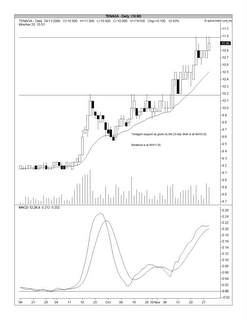

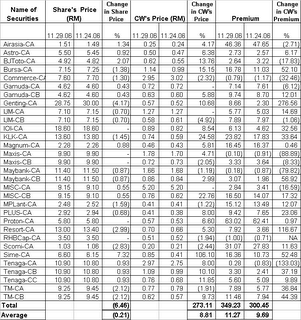

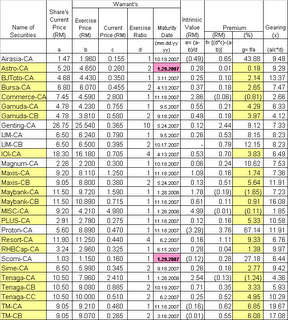

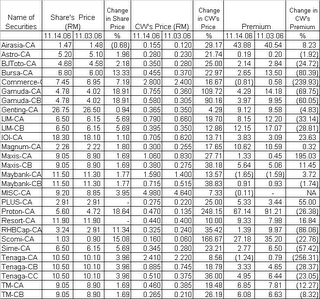

I have updated the list of call warrants below. Included in the list are 2 new call warrants i.e.

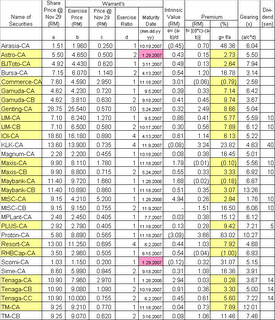

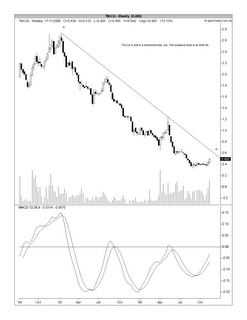

TM has broken above its medium-term downtrend line at RM9.00 on November 7. Thereafter it continued to drift sideway. Besides the downtrend line, TM share price also faces a strong horizontal resistance of RM9.20, which has been in place since June.

For the traders, you may like to try out TM-CA, the call warrant of TM, with an exercise ratio of 1:1; an exercise price of RM9.21 & expiring on November 18, 2007. At the price of RM0.595 at the close of this morning session (with the mother price of RM9.45), TM-CA is trading at a premium of 3.8% only. Chartwise, TM-CA hasn’t broken above its downtrend line yet, even after this morning’s sharp rise (see Chart 3 below). To achieve a breakout, TM-CA needs to surpass the RM0.65/66 level.

In conclusion, I believe TM is now a good buy after this morning’s breakout. Even though TM-CA hasn’t broken above its downtrend line yet, I believe it is likely to happen soon. A good entry for TM is probably now. TM-CA is trickier but a gradual entry starting now would be safer (without missing the boat).

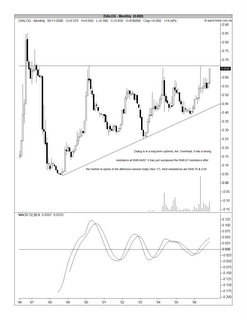

Yesterday, Maxis-CA has a very sharp run-up. It gained 18.5 sen to close at RM1.06. In the process, Maxis-CA has broken above two important resistances i.e. the medium-term downtrend line which commenced in w/e Jan 14, 2005 at the RM1.03 level as well as the psychological resistance of RM1.00. With this breakout, Maxis-CA may test the next resistances at RM1.15 & RM1.35. See Chart 1 below.

The mother share has gained 20sen to close at RM9.05, yesterday. It is important that the share should surpass the RM9.05 or 9.10 resistance, which has been in place since November 2005 (see Chart 2 below). Unless this happens, the rise in the price of Maxis-CA is not likely to sustain.

Chart1: Maxis' weekly as at Nov 14

By 11.00 a.m. this morning, the share has broken above the RM9.05/10 resistance to touch RM9.20 while Maxis-CA gained 19 sen to touch RM1.25. For those who are interested to gain entry to Maxis, the level to look out for is RM9.05/10. An exposure via Maxis-CA may be a bit tricky after this current sharp run-up. You may want to see whether it can pull back to resistance-turned-support levels such as RM1.15 or a much safer level RM1.00.

Maxis-CA has an exercise ratio of 1:1; an exercise price of RM8.11 & expiring on November 18, 2007. At the price of RM1.25 at 11.00 a.m. this morning (with the mother price of RM9.20), Maxis-CA is trading at a premium of 1.7% only.