The 1000 level is an important psychological level & since it lies 20 points above the 980 level, the 1000-mark looks like a target to shoot for. Can a market, which has been consolidating for 3 years, make a breakout & be happy with a 20-point or 2% gain? The answer is obviously NO.

What you are likely to see over the next few days, or even weeks, will be a close fight. At every break below the 1000-mark, the bears will stamp their feet & cheer. Fresh selling will pile in. Watch how the selling & buying will be carried out. At every recovery above the 1000-mark, the bulls will stamp their feet & cheer. The buying will come in. Again, watch how the buying & selling will be carried out. It is good that the market is fixated with the 1000-mark. But, we must bear in mind that the 1000-mark is a forward defensive line. A break of the 1000-mark is not the end of this nascent rally. We still have the 980 level to fall back on.

From the above commentary, you may say I’m bullish about the market. I would not disagree with that observation.

Chart 1: CI's weekly chart as at Nov 7

Comment: The CI has clearly broken above the wedge at the 980 level.

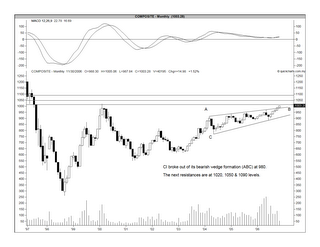

Chart 2: CI's monthly chart as at Nov 7

Comment: The CI's next resistances are at 1020, 1050 & 1090 level.

No comments:

Post a Comment