Ranhill Utilities Bhd ("RUBhd") is involved in the collection and treatment of raw water and the distribution of treated water to consumers in the State of Johor, commencing from 1 March 2000 for a period of 30 years. The water supply concession is held by RUBhd's wholly-owned subsidiary, SAJ Holdings Sdn Bhd ("SAJH"). RUBhd is, in turn, a 70%-owned subsidiary of Ranhill Bhd.

Until recently, the water distributed by SAJH comes from 3 sources- its own treatment plants, 2 plants belonging to Equiventures Sdn Bhd and 14 plants belonging to Southern Water Corporation Sdn Bhd. The water supplied by Equiventures & Southern Water Corp accounts for 65% of all the water distributed by SAJH.

Under the terms of the original Concession Agreement, SAJH is entitled to a tariff review every three years. The last review was supposed to be on Jan 1, 2005. The management believed that SAJH was entitled to request for a 48%-hike in the tariff rate but the State Government had requested SAJH to forego the tariff hike in return for some concessions, which would lower the cost of water purchased by SAJH. These concessions were to be implemented via a restructuring scheme (for more details of the scheme, go to the end of this post).

Recent Financial Performance

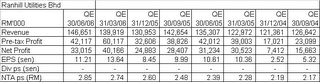

RUBhd has recently announced its result for QE30/6/2006. Net profit has increased by 5.7% y-o-y to RM33.0 mil but declined by 17.8% when compared to net profit for QE31/3/2006 of RM40.2 mil. The latter was attributable to the increase in depreciation charge and finance costs as a result of the increase in completed projects. Turnover has increased by 4.8% q-o-q or 8.4% y-o-y to RM146.6 mil.

When a comparison is made between the latest 4 quarterly results with the preceding 4 quarterly results, you can see that turnover has increased by 10.6% to RM560.2 mil while net profit has increased by 50.3% to RM127.5 mil. EPS has also improved by 50.3% from 28.8 sen to 43.3 sen. For more, see the table below.

Valuation

Based on a EPS of 48.3 sen & yesterday (August 28)'s closing price of RM1.35, RUBhd is now trading at a PE of 2.8 times. That is very, very cheap. It is so cheap that it makes you wonder why. Could it be because of the uncertainties surrounding all water stocks now, or is it something else?

Technical Picture

From Chart 1, you can see that RUBhd has broken out of its long-term downtrend yesterday when it surpassed the RM1.28/30 resistance to close at RM1.35. From the daily chart (Chart 2), you will see that the current share run-up is quite bullish, with runaway gaps present but unfortunately with only small volume. If exhaustion set in, the pullback can be quite substantial. The critical level that it should not breach is the RM1.28/30 level, otherwise the breakout would be deemed to be a failed breakout.

Chart 1: RUBhd's weekly chart as at August 28

Chart 2: RUBhd's daily chart as at August 28

Recommendation

Based on cheap valuation & the potentially bullish breakout on the technical front, I believe that the long-term outlook of RUBhd to be very bright.

Restructuring Scheme in more details

The main changes are:

1. SAJH is released from its obligations to purchase treated water and to pay for the bulk sales rate payment and the fixed monthly payment to the State Government and Syarikat Air Johor Sdn Bhd (“SAJSB”), arising from the purchase of treated water from the independent water treatment operators, namely Equiventures and Southern Water Corporation (“Water Operators”). Instead, SAJH will purchase treated water from Johor Special Water Sdn Bhd, a single purpose company set up by the State Government ("SPV") in accordance with the terms of the Water Supply Agreement.

2. During the supply period [3 months from Jan 1, 2006 to Mar 31, 2006], SPV shall purchase from the State Government and SAJSB such quantity of treated water that they are obligated to purchase from the Water Operators and shall supply the same to SAJH. The amount of water to be supplied is 97,700,000 m3 at a cost of RM90.0 million. This amount shall be paid by installments on deferred payment basis from the year 2007 up to 2013.

3. Upon expiry of the supply period (i.e. Apr 1, 2006), the SPV will lease water treatment assets (handled over by the Water Operators) to SAJH for the period up to 2014. The total lease payment will be up to RM1.015 billion to be payable from 2014 to 2025.

4. After 2014, SAJH shall continue to use the leased water treatment assets until full settlement of the sum of RM1.015 billion and thereafter the assets shall be transferred to SAJH, on payment of a minimal sum.

Implementation of the Restructuring Scheme

By now, SAJH should have taken possession of the leased water treatment plants but that has not happened yet. This is because the Restructuring Scheme has yet to be fully implemented. The SPV is now nearing the completion of their bond issuance and thereafter, the Water Operators will be paid for transferring over their water treatment plants to the SPV. Despite the delay, the water supply has not been interrupted & RUBhd has been holding up to their end of the bargain (which is not too hard since it doesn't have to do anything).

1 comment:

who are the "Water Operators" as noted? Any TP for RUBHD?

recently price surge alot... any insider news?

Post a Comment