KLCC Property Holdings Bhd ("KLCCP") & Krisassets Holidings Bhd ("Kassets") are amongst the biggest property investment companies listed on the Bursa Malaysia.

KLCCP is the owner of KLCC Suria Shopping Center, the KLCC Twin Towers & a few other buildings located within the vicinity of the KLCC as well as other properties such as the Dayabumi building. In total, the properties owned by KLCCP are valued at RM6.26 billion (valuation was carried out in QE 30/6/2006).

Kassets is the owner of the Mid-Valley Megamall as well as a few other buildings located next to it. In total, the properties owned by Kassets are valued at RM1.68 billion (valuation was carried out in QE 31/3/2006). While the value of Kassets’ properties owned maybe smaller, this will be given a boost when the new phase of Mid-Valley Megamall is completed in 2008.

Financial Performance

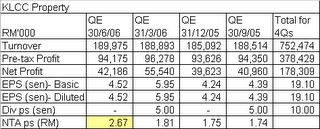

Based on the latest 4 quarterly result, KLCCP's net profit amounted to RM178.3 mil while turnover totaled RM752.5 mil. KLCCP's EPS for the 4 quarters amounted to 19.1 sen. Based on a NTA per share of RM2.67 as at 30/6/2006, the Return on Shareholders' Funds is about 7.15%.

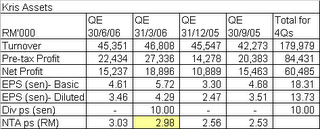

For the same period, Kassets managed to report a net profit of RM60.5 mil on the back of a turnover of RM180.0 mil. Kassets' basic EPS for the 4 quarters amounted to 18.3 sen. Based on a NTA per share of RM3.03 as at 30/6/2006, the Return on Shareholders' Funds is about 6.04%.

Table 1: KLCCP's 4 quarterly results

Table 2: Kassets' 4 quarterly results

Valuation

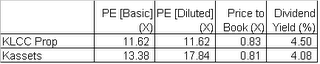

Based on the Table 3, we can see that KLCCP is cheaper than Kassets in term of PE multiple. KLCCP's Dividend Yield is slightly higher than that of Kassets. In term of Price to Book, Kassets is marginally more attractive than KLCCP.

Table 3: KLCCP & Kassets' PE, P/Book & Div Yield comparison

Technical Picture

From Chart 1 below, we can see that KLCCP is trapped in a range between RM2.05 & RM2.30. A move above or below these levels would signal the direction of KLCCP's next price movement. Until then, the share will be range-bound, which is ideal for swing trading.

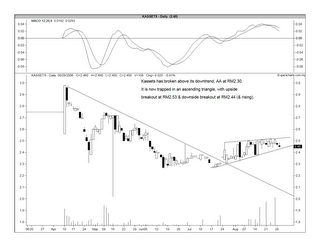

Kassets is trapped in an ascending triangle with upside breakout/resistance at RM2.53 and downside breakout/support at RM2.44 (& rising). Until then, there is not much room for trading for Kassets.

Chart 1: KLCCP's weekly chart as at August 29

Chart 2: Kassets' daily chart as at August 29

Conclusion

Based on the above, we can see that KLCCP is fundamentally more attractive than Kassets. Technically speaking, KLCCP offers some rooms for swing trading until it breaks out of its trading range (RM2.05-2.30) while one has to be patient to wait for Kassets to do a positive breakout at RM2.53, before a technical "buy" signal is activated.

Update made on September 11, 2006

From The Edge w/e Sep 11, I have learned that Kassets owns only the Mid-Valley Megamall. The other components of the Mid-Valley project such as the 4-star Boulevard Hotel, 3-star Cititel Hotel, Menara IGB, Centrepoint North & South office towers plus the Phase 2 of the Mid-Valley project such as the upscale shopping mall (known as The Garden), another 2 office blocks, a 5-star hotel & a block of upmarket service apartment are all held directly under Kassets' parent company i.e. IGB.

Please note that the earlier background information on Kassets made in this post were incorrect.

No comments:

Post a Comment