As such, MPI's EPS for the 2H2006 amounts to 35.55 sen while its full year's EPS is 53.86 sen. Using only the 2H2006 EPS as a base, we can arrived at an EPS of 71.10 sen for FYE2007. Based on yesterday (Aug 17)'s closing price of RM10.10, MPI is now trading at a PE of 14.2 times its 2007 EPS.

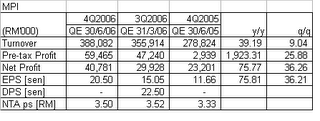

Table 1: MPI's Financial Results for QE 30/6/2006

On the other hand, Unisem's net profit increased by almost 9 folds y-o-y to RM16.1 mil on the back of a 30.7%-increase in turnover of RM173 mil. Net profit has, however, dropped by 26.2% q-o-q while turnover has only increased by 1.6% from the immediately preceding quarter (see Table 2 below).

Unisem's EPS for the 1H2006 amounts to 8.58 sen. Based on this, we can arrived at an annualised EPS of 17.16 sen for FYE2006. Based on yesterday (Aug 17)'s closing price of RM1.50, Unisem is now trading at a PE of 8.74 times its 2006 EPS. Based on PE comparison, Unisem looks like a cheaper stock than MPI.

Table 2: Unisem's Financial Results for QE 30/6/2006

The technical picture of MPI & Unisem are quite similar. Both have yet to break above their respective downtrend lines (RM10.20 for MPI & RM1.65 for Unisem). A break above this level would make each stock a BUY. Their charts are appended below.

Chart 1: Unisem's weekly chart as at August 17

Chart 2: MPI's weekly chart as at August 17

No comments:

Post a Comment