PLUS Expressway Bhd ("PLUS") has been affected by a stagnant traffic growth for the past 3 months. Its flagship concession, the North South Expressway ("NSE") has registered a traffic growth rate of 0.4% in March, 0.6% in April and 0.4% in May. This is well below the forecast furnished in its prospectus issued in 2001 when PLUS applied for its listing on KLSE. In that forecast, traffic for NSE is projected to grow at 5.4% for 2006.

The drop in the traffic growth rate is attributed to the unexpected 30 sen hike in petrol price in March this year. This has caused some commuters to seek alternative means of transport or even cutting back on long-haul/outstation trip.

Current Financial Performance

The latest available quarterly result is for QE 31/3/2006. The results for QE 30/6/2006 is likely to be announced in the 3rd week of this month. Since the traffic on the expressway was still growing, albeit at a much slower rate, I expect the result for QE 30/6/2006 to be in line with the past few quarters' performance. As such, PLUS' EPS is likely to be about 17 sen.

Valuation

Based on this morning (August 22)'s closing price of RM2.70 & EPS of 17 sen, this will give you a PE of about 15.9 times.

An old CIMB's research report dated Nov 25, 2005 (the only one that I've managed to get my hands on) has computed a DCF-based target price is RM3.96 for PLUS. This target price may have to be revised downward since the overnight policy rate (OPR) have been revised upward from 2.7% in November 2005 to 3.5% today.

Technical Outlook

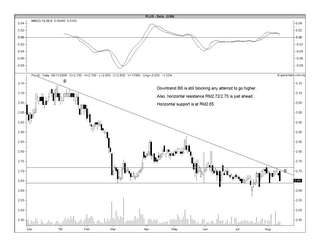

PLUS made a high of RM3.42 in August 2005 & since then, it has been drifting down. The recent low was RM2.57 in July. If PLUS' share price can surpass the downtrend line at RM2.72, the current downtrend could be over. See Chart 1 & 2 below.

Chart 1: PLUS' weekly chart as at August 21

Chart 2: PLUS' daily chart as at August 21

Recommendation

Based on the above, PLUS could be a good LT investment if the share price can break above RM2.72 convincingly.

No comments:

Post a Comment