Choo Bee Metal Industries Bhd (“Choo Bee”) is involved in the processing of steel coils into steel pipes & other related products and trading of hardware products.

Current Financial Performance

It reported an improved performance for 2Q2006. Its net profit increased by 34.1% q-o-q or 43.7% y-o-y to RM 8.7mil. Turnover has increased by a lesser quantum of 0.9% q-o-q or 16.2% y-o-y to RM 88.3 mil.

The latest 4 quarters’ cumulative turnover is 4.7% higher than the preceding 4 quarters’ turnover. Despite the higher turnover, net profit for the same periods is lower by 52.6% from RM 38.2 mil to RM 18.1 mil. The drop in net profit was due substantially to the writing down of inventory totaling RM 13.4 mil, which were carried out in QE 31/12/2005 & QE 30/09/2005.

Going forward, Choo Bee may benefit from the greater demand for its pipes, both from the water sector as well as from the oil & gas sector.

Valuation

Based on the EPS for QE 30/06/2006 & QE 31/03/2006 totaling 14.52 sen, the annualized EPS of Choo Bee is estimated to be about 29.04 sen. This is slightly higher than S&P's forecast of 2006 EPS of 26.2 sen in its report dated August 22, 2006. S&P has rated Choo Bee as a STRONG BUY with a 12-mth target of RM1.98.

Based on EPS of 29 sen & share price of RM1.56 (today closing price), Choo Bee is now trading at a PE of 5.4 times.

Technical Picture

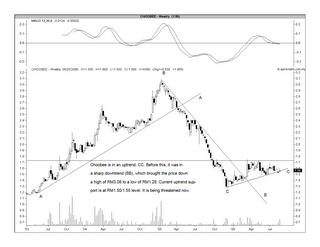

As noted below, Choo Bee is in a ST uptrend, with support at RM1.50/1.55. Overhead horizontal resistance is at RM1.73.

Chart: Choo Bee's weekly chart as at August 22

Recommendation

Based on fairly cheap valuation, Choo Bee is considered a good LT investment.

No comments:

Post a Comment