Tamco Corporate Holdings Bhd ("Tamcorp") is involved in the design, manufacturing, installation & distribution of electrical equipment & systems. Its financial performance has improved in the past 1 years (see Table below). Based on the past 3 quarters' EPS that averaged about 1 sen, Tamcorp's full year's EPS would be about 4 sen. Since the share closed at RM0.405 yesterday (August 2), that means Tamcorp is now trading at a PE of about 10 times. That's about fair value for any stock but it may still be considered inexpensive for a Mesdaq counter.

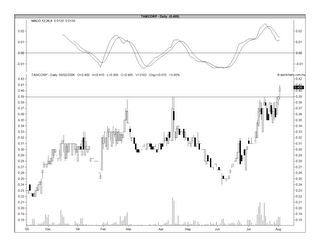

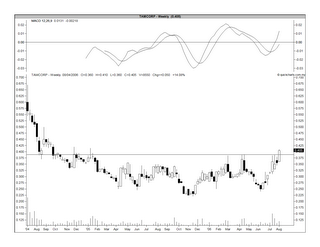

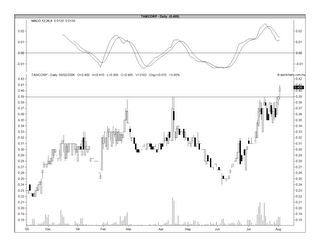

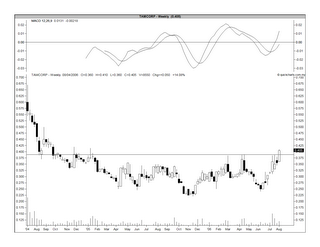

What's interesting is that the share did a bullish breakout yesterday when it surpassed a strong horizontal resistance of RM0.39 (see Chart 1 & 2 below). The only thing lacking is a big increase in volume accompanying the breakout. Nevertheless,based on the bullish breakout, the stock is now a good BUY canditate. Target objective maybe as high as RM0.50-0.55.

Chart 1: Tamcorp's daily chart as at August 2

Chart 1: Tamcorp's daily chart as at August 2

Chart 2: Tamcorp's weekly chart as at August 2

No comments:

Post a Comment