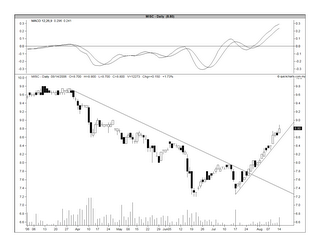

Since my bullish call on August 1, the share price of MISC has gained about 9% to RM8.80, based on yesterday (August 14)'s closing price. The share is in a steep ST uptrend line with support at RM8.60. A break of this uptrend would lead to correction with support seen at RM8.50 and then RM8.00 (see Chart below).

Chart: MISC's daily chart as at August 14

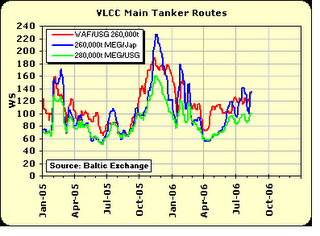

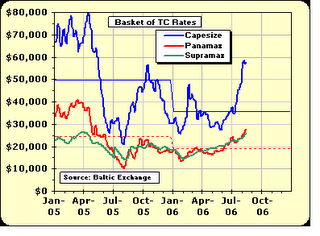

The latest charts on the movement of freight rates for tankers & bulk carriers, which are appended below, are supportive of my view that the rates have probably bottomed.

Chart for VLCC/ULCC Markets w/e 11th August 2006

Chart for Dry Bulk Markets w/e 11th August 2006

No comments:

Post a Comment