Based on the table below, the stock with the lowest PE is Subur Tiasa (PE of 8.4X) and the one with the highest PE is Lingui (PE of 44X). The reason for Lingui's poor performance vis-a-vis its peer is because it has a planted timber concession in New Zealand which is only beginning to be harvested. This dragged down its net profit but as the trees are now being harvested, its performance may surprise on the upside.

Based on PE consideration, you may want to look at Subur Tiasa. Based on lagged share price performance, Lingui may be a good choice.

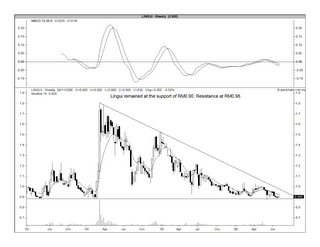

Chart 1: Lingui's weekly chart as at August 9

Chart 2: WTK's weekly chart as at August 9

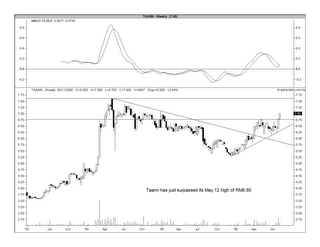

Chart 3: Ta Ann's weekly chart as at August 9

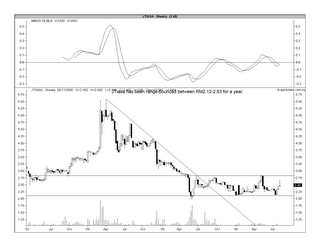

Chart 4: JTiasa's weekly chart as at August 9

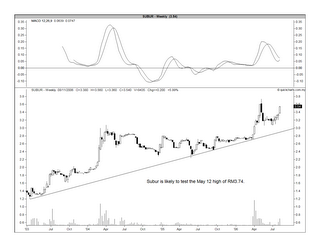

Chart 5: Subur's weekly chart as at August 9

No comments:

Post a Comment