"MISC has been on an uptrend since July 2003 but this was broken in April 2006. During that period, the share price moved from RM3.70 to a high of RM10.10- gaining RM6.40 or 173%!!! Since the breakdown in April 2006, the share price hit a low of RM7.20 on June 21- giving back 45% of its prior gain of RM6.40. Have the stock reached a level that warrants accumulation?"

Since then, 2 things have happened:

1. MISC has slowly recovered from the low of RM7.20 (done on June 20 & 21) to reach a high of RM7.95 before succumbing to a brief selloff that brought the share price down to a low of RM7.25 on July 1. Thereafter, the share bounced back to break above the downtrend line at RM7.80 on July 25. In the past 4 days, the share has been hovering around the RM8.00 (see the Chart below).

Chart: MISC's daily chart as at July 31

2. The shipping rates have continued to firm up.

Chart for Dry Bulk Markets w/e 28th July 2006

Chart for VLCC/ULCC Markets w/e 28th July 2006

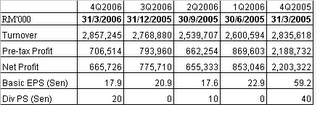

No new financial results were announced since my June e-mail. The latest quarterly result available is for QE 31/3/2006 (see the Table below). To recap, the turnover increased 3.2% q-o-q or 0.8% y-o-y to RM2.86 billion while net profit dropped 14.2% q-o-q or 69.8% y-o-y to RM665.7 mil. The sharp drop in net profit when compared to last year's same quarter is attributable to extraordinary gain in QE 31/3/2005 of RM1.45 billion, which came from the sale of vessels. If this item is excluded, the net profit declined by only 11.1% y-o-y. Based on the cumulative last 4 quarters' EPS of 79 sen and a share price of RM8.05 (closing price on August 1), MISC is now trading at a PE of 10.2 times.

Based on the improving technical outlook for both the share price and the overall shipping rates, I believe MISC share price is likely to go higher.

No comments:

Post a Comment